Hey there, diving into the world of tax planning tips! Get ready to uncover the secrets of minimizing your tax liabilities and maximizing your financial goals in a cool and engaging way.

In this guide, we’ll explore different strategies, deductions, and retirement planning techniques that can help you navigate the complex world of taxes like a pro.

Importance of Tax Planning

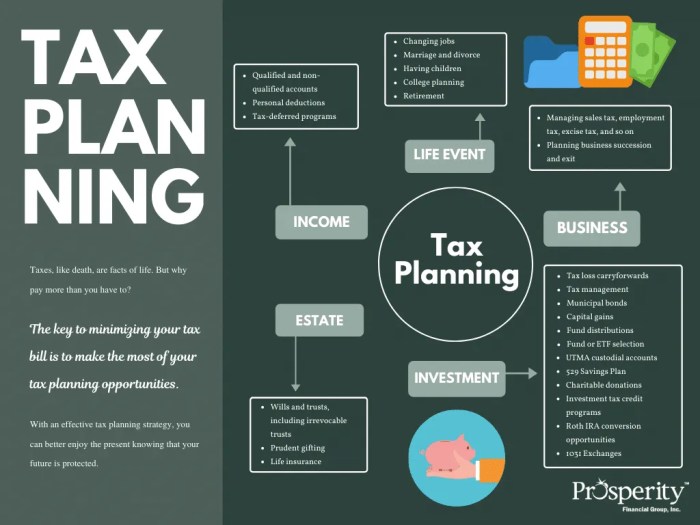

Tax planning is a crucial aspect for both individuals and businesses as it involves strategizing to minimize tax liabilities while maximizing savings. Effective tax planning can lead to significant financial benefits and help individuals and businesses achieve their financial goals.

Benefits of Effective Tax Planning

- Reduce Tax Liabilities: By identifying deductions, credits, and exemptions, tax planning can help lower the amount of taxes owed.

- Maximize Savings: Proper tax planning can help individuals and businesses save money by legally minimizing their tax burden.

- Improve Cash Flow: By strategically planning for taxes, cash flow can be optimized, allowing for better financial management.

Examples of Minimizing Tax Liabilities

- Utilizing Retirement Accounts: Contributing to retirement accounts such as 401(k) or IRA can reduce taxable income and lower tax liabilities.

- Taking Advantage of Tax Credits: Claiming tax credits for education expenses or energy-efficient home improvements can help reduce taxes owed.

- Charitable Contributions: Donating to qualified charities can result in tax deductions, reducing taxable income.

Role of Tax Planning in Achieving Financial Goals

Tax planning plays a vital role in achieving financial goals by ensuring that resources are allocated efficiently and tax implications are considered in financial decisions. By incorporating tax planning strategies into financial planning, individuals and businesses can work towards building wealth and securing their financial future.

Tax Planning Strategies

Tax planning strategies are essential for individuals and businesses to minimize their tax liabilities and maximize their savings. By strategically managing income, deductions, and investments, taxpayers can take advantage of various strategies to optimize their tax situation.

Short-term vs. Long-term Tax Planning

Short-term tax planning involves immediate actions to reduce tax liabilities for the current tax year, such as maximizing deductions and credits. On the other hand, long-term tax planning focuses on creating a sustainable tax strategy over several years by considering factors like retirement planning, estate planning, and investment strategies.

Impact of Tax-efficient Investing

Tax-efficient investing is crucial for overall financial planning as it helps investors minimize the tax impact on their investment returns. By utilizing tax-advantaged accounts like IRAs and 401(k)s, as well as strategies like tax-loss harvesting and asset location, investors can enhance their after-tax returns and grow their wealth more effectively.

Timing of Income and Deductions

The timing of income and deductions can significantly influence tax planning decisions. By deferring income to future years or accelerating deductions into the current year, taxpayers can strategically manage their taxable income and reduce their overall tax burden. This approach allows individuals and businesses to take advantage of lower tax rates or deductions when they are most beneficial.

Maximizing Tax Deductions

When it comes to maximizing tax deductions, individuals and businesses need to be aware of the various opportunities available to them. By taking advantage of common deductions and staying informed about changes in tax laws, taxpayers can significantly reduce their tax liabilities. Proper record-keeping is also key to ensuring that all eligible deductions are claimed. Let’s dive into some essential tips and strategies for maximizing tax deductions.

Common Tax Deductions

- Charitable donations: Donations made to qualified charitable organizations can be deducted from taxable income.

- Mortgage interest: Homeowners can deduct the interest paid on their mortgage, up to a certain limit.

- Medical expenses: Medical expenses that exceed a certain percentage of your income can be deducted.

Maximizing Deductions through Record-keeping

Proper record-keeping is crucial for maximizing deductions. Keep track of all expenses, receipts, and documentation that support your deductions. This includes maintaining organized records of charitable donations, business expenses, and any other deductible costs. By staying organized, you can ensure that you are claiming all eligible deductions and avoiding any potential issues with the IRS.

Staying Informed about Tax Law Changes

Tax laws are constantly evolving, and staying informed about changes is essential for maximizing deductions. Be aware of any new deductions or credits that may be available to you each year. Consulting with a tax professional can help you navigate the complexities of the tax code and identify opportunities to reduce your tax burden.

Overlooked Deductions

- Educator expenses: Teachers can deduct out-of-pocket expenses for classroom supplies.

- State and local taxes: Taxpayers can deduct state and local income taxes or sales taxes paid.

- Job search expenses: Costs related to finding a new job, such as resume preparation and travel, may be deductible.

Retirement Planning and Tax Efficiency

When it comes to tax planning, retirement planning plays a crucial role in maximizing tax efficiency. By strategically saving for retirement, individuals can take advantage of various tax benefits and reduce their tax liabilities.

Tax-Advantaged Retirement Accounts

One of the key components of tax-efficient retirement planning is utilizing tax-advantaged retirement accounts such as 401(k), IRA, Roth IRA, and HSA. These accounts offer tax benefits either upfront or upon withdrawal, allowing individuals to grow their retirement savings more effectively.

- Contributions to traditional 401(k) and IRA accounts are tax-deductible, reducing taxable income in the year of contribution.

- Roth IRA contributions are made with after-tax dollars, but qualified withdrawals are tax-free, providing tax-free growth.

- HSA contributions are tax-deductible and withdrawals for qualified medical expenses are tax-free, making it a triple tax-advantaged account.

Maximizing Tax Efficiency in Retirement Savings

To maximize tax efficiency in retirement savings, individuals should consider factors such as their current tax bracket, expected future tax bracket, and retirement goals. By strategically allocating funds across different retirement accounts and taking advantage of tax deductions and credits, individuals can optimize their tax situation in retirement.

By diversifying retirement savings across taxable, tax-deferred, and tax-free accounts, individuals can create a tax-efficient withdrawal strategy in retirement.

Comparing Retirement Planning Strategies

When evaluating retirement planning strategies from a tax perspective, individuals should consider factors such as contribution limits, eligibility criteria, tax treatment of contributions and withdrawals, and potential penalties. Comparing the pros and cons of different retirement accounts can help individuals choose the most tax-efficient strategy based on their unique financial situation.