Get ready to dive into the world of real estate vs stocks, where we unravel the differences and similarities between these two investment giants in an epic showdown of financial prowess.

From the historical performance trends to the key factors investors consider, this comparison will take you on a journey through the highs and lows of investing in real estate and stocks.

Real Estate vs. Stocks

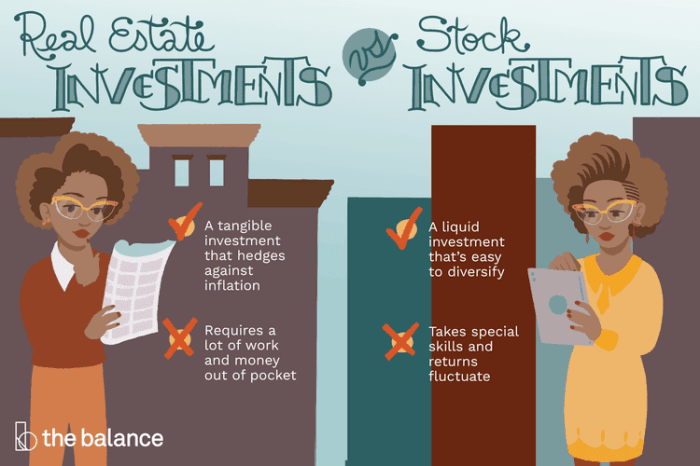

Investing in real estate and stocks are two popular options for investors looking to grow their wealth. While both can offer opportunities for financial growth, there are some key differences between the two.

Real estate investing involves purchasing properties such as houses, apartments, or commercial buildings with the goal of generating rental income or selling the property for a profit. On the other hand, investing in stocks means buying shares of publicly traded companies, allowing investors to participate in the company’s growth and profitability.

Historically, real estate has been seen as a more stable investment option, with less volatility compared to the stock market. Real estate values tend to appreciate over time, providing a reliable source of long-term wealth accumulation. Stocks, on the other hand, are known for their higher potential returns but also come with greater risk due to market fluctuations.

When choosing between real estate and stocks, investors consider factors such as risk tolerance, investment goals, timeframe, and level of involvement required. Real estate investments typically require more active management, including property maintenance and tenant relations, while stocks offer a more passive investment approach that can be easily traded on the stock market.

In summary, real estate and stocks offer different opportunities for investors based on their individual preferences and financial goals. Understanding the key differences between the two can help investors make informed decisions about where to allocate their investment capital.

Real Estate Investment

Investing in real estate can take various forms, providing individuals with opportunities to diversify their portfolios and generate passive income. Let’s explore some of the ways people can invest in real estate, along with the potential advantages and risks associated with this type of investment.

Rental Properties

Investing in rental properties involves purchasing residential or commercial properties and renting them out to tenants. This can provide a steady stream of rental income, potential tax benefits, and the opportunity for property appreciation over time.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. By investing in REITs, individuals can gain exposure to real estate without directly owning properties. REITs often offer high dividend yields and liquidity compared to owning physical properties.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their funds to invest in real estate projects. This method provides access to real estate investments with lower capital requirements, diversification across different properties, and the potential for high returns. However, it also comes with risks such as project delays, default, or loss of investment.

Potential Advantages of Real Estate Investment

Investing in real estate offers several advantages, including diversification of investment portfolios, passive income from rental properties, potential tax benefits such as depreciation deductions and capital gains tax advantages, and the opportunity for property appreciation over time.

Risks Associated with Real Estate Investment

Despite the benefits, there are risks involved in real estate investment. Market volatility can affect property values and rental income, making real estate investments sensitive to economic conditions. Illiquidity is another risk, as selling a property may take time and incur costs. Property management challenges, such as dealing with tenants, maintenance issues, and regulatory requirements, can also pose risks to investors.

Stock Market Investment

Investing in the stock market can be a lucrative way to grow your wealth over time. There are different types of stocks available for investment, each with its own unique characteristics.

Types of Stocks

- Blue-Chip Stocks: These are shares of large, well-established companies with a history of stable performance and reliable dividends.

- Growth Stocks: These are stocks of companies that are expected to grow at a faster rate than the market average, offering the potential for high returns.

- Dividend Stocks: These are stocks that pay out a portion of their earnings to shareholders in the form of dividends, providing a steady income stream.

Advantages of Investing in Stocks

- High Liquidity: Stocks can be easily bought and sold on the stock exchange, allowing investors to access their funds quickly.

- Potential for High Returns: Stocks have historically provided higher returns compared to other investment options like bonds or savings accounts.

- Ease of Diversification: Investing in a variety of stocks can help spread risk and protect against market fluctuations.

Risks of Stock Market Investments

- Market Volatility: Stock prices can fluctuate rapidly due to various factors such as economic conditions, company performance, or geopolitical events.

- Company-Specific Risks: Investing in individual stocks carries the risk of company-specific issues like management changes, regulatory problems, or competition.

- Potential for Loss of Principal: There is always a risk of losing money in the stock market, especially if the value of your investments declines.

Factors Influencing Investment Decisions

When deciding between real estate and stocks, several key factors come into play that can greatly influence the investment decision. These factors include risk tolerance, investment goals, time horizon, and current market conditions.

Risk Tolerance

Risk tolerance refers to an investor’s willingness to endure fluctuations in the value of their investments. Real estate tends to be less volatile compared to stocks, making it a more suitable option for investors with lower risk tolerance. On the other hand, stocks have the potential for higher returns but also come with higher risk, making them more suitable for investors willing to take on more risk.

Investment Goals

Investment goals play a crucial role in deciding between real estate and stocks. For long-term wealth preservation and steady income streams, real estate might be a more suitable investment. Conversely, for investors looking for capital appreciation and growth, stocks can offer higher potential returns.

Time Horizon

The time horizon of an investor also impacts the choice between real estate and stocks. Real estate investments are typically long-term in nature and require patience for value appreciation. Stocks, on the other hand, offer more liquidity and flexibility for short-term trading or long-term growth, depending on the investor’s time horizon.

Market Conditions

Market conditions, such as interest rates, inflation, and overall economic outlook, can significantly impact the decision-making process for investing in real estate or stocks. For example, low-interest rates might make real estate financing more attractive, while high inflation could erode stock returns. Understanding these market conditions is crucial for making informed investment decisions.