Diving into the world of real estate investment strategies, we uncover the keys to success in this lucrative industry. From buy and hold to fix and flip, we explore the diverse approaches that can lead to financial prosperity and long-term growth. Get ready to learn the ins and outs of real estate investing like never before.

Real Estate Investment Strategies

Real estate investment is the practice of purchasing, owning, managing, renting, or selling real estate for profit. It involves generating income through rental properties, appreciation of property value, and real estate trading.

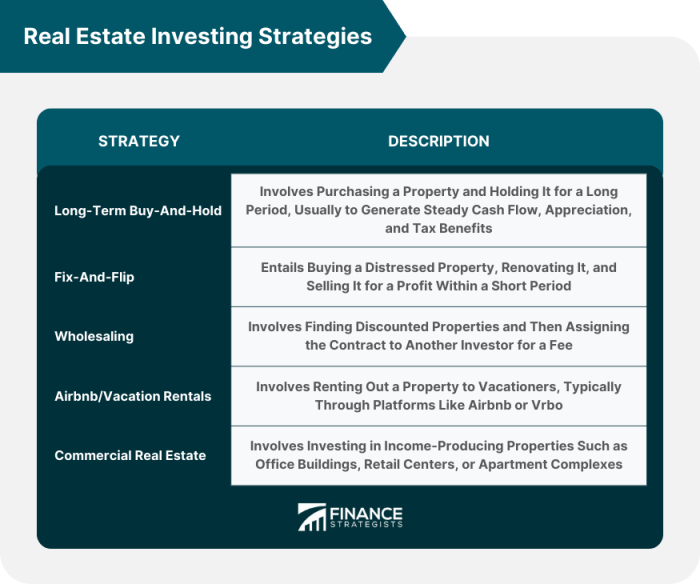

Types of Real Estate Investment Strategies

- Buy and Hold: Investors purchase properties to rent them out for a long-term investment, generating rental income and potential appreciation over time.

- Fix and Flip: Investors buy properties that need renovation, improve them, and sell for a profit in a short period.

- Wholesaling: Investors secure properties under contract and assign the contract to another buyer for a fee without actually purchasing the property.

- REITs (Real Estate Investment Trusts): Investors buy shares in companies that own and operate income-producing real estate, providing diversification and liquidity.

Successful real estate investment strategies require thorough research, financial analysis, and market knowledge to minimize risks and maximize returns.

Buy and Hold Strategy

The buy and hold strategy in real estate investing involves purchasing a property with the intention of holding onto it for an extended period of time, typically years or even decades. This approach focuses on long-term appreciation and cash flow rather than short-term gains.

How Buy and Hold Strategy Works

When implementing the buy and hold strategy, investors look for properties in stable or growing markets that have the potential to increase in value over time. They aim to generate rental income from tenants while waiting for the property to appreciate in value. By holding onto the property for the long term, investors can benefit from both rental income and capital appreciation.

- Investors buy a property and hold onto it for an extended period of time, usually years.

- They earn rental income from tenants living in the property.

- Over time, the property’s value appreciates, allowing investors to sell it for a profit.

Advantages and Disadvantages of Buy and Hold Strategy

- Advantages:

- Steady Cash Flow: Investors can generate a consistent stream of income from rental payments.

- Long-Term Appreciation: Properties have the potential to increase in value over time, providing a profitable return on investment.

- Tax Benefits: Investors may benefit from tax advantages such as depreciation deductions and capital gains tax rates.

- Disadvantages:

- Lack of Liquidity: Real estate is not a liquid asset, meaning it may take time to sell the property if needed.

- Market Risks: Economic downturns or changes in the real estate market can impact property values and rental demand.

- Ongoing Maintenance: Investors are responsible for property upkeep and maintenance costs, which can eat into profits.

Fix and Flip Strategy

When it comes to real estate investment, the fix and flip strategy involves purchasing a property, renovating it to increase its value, and then selling it for a profit in a relatively short period of time. This strategy can be lucrative if done correctly, but it also comes with its own set of challenges.

Steps Involved in a Fix and Flip Strategy

- Find a suitable property: Look for properties that are priced below market value and have the potential for improvement.

- Secure financing: Obtain funding for the purchase and renovation of the property, either through a traditional mortgage, hard money lender, or private investor.

- Renovate the property: Make strategic renovations to increase the property’s value, focusing on upgrades that will appeal to potential buyers.

- Market the property: Once the renovations are complete, list the property for sale and work with a real estate agent to attract potential buyers.

- Sell the property: Close the sale and collect your profit, ideally making a substantial return on your investment.

Tips for Success in Fix and Flip Strategy

- Do your research: Thoroughly evaluate the property and market conditions before making any investment decisions.

- Set a realistic budget: Create a detailed budget for renovations and stick to it to avoid overspending.

- Hire reliable contractors: Work with experienced contractors who can complete renovations efficiently and to a high standard.

- Stay proactive: Monitor the progress of the renovation closely and address any issues that arise promptly to keep the project on track.

- Understand the market: Have a good understanding of the local real estate market and trends to ensure you can sell the property quickly and for a profit.

Rental Property Investment

Investing in rental properties can be a lucrative venture with various benefits for investors looking to generate passive income and build long-term wealth.

Benefits of Investing in Rental Properties

- Diversification of Investment Portfolio: Rental properties can provide a stable source of income that is not directly tied to stock market fluctuations.

- Passive Income: Rental properties offer regular rental payments from tenants, providing a steady stream of cash flow.

- Appreciation: Over time, rental properties have the potential to increase in value, allowing investors to build equity.

- Tax Advantages: Investors can benefit from tax deductions on mortgage interest, property taxes, and other expenses related to owning rental properties.

Key Considerations when Investing in Rental Properties

- Location: Choose rental properties in areas with high demand and potential for rental income growth.

- Property Management: Consider whether to manage the property yourself or hire a professional property management company.

- Financial Analysis: Conduct a thorough financial analysis to ensure the property will generate positive cash flow and meet your investment goals.

- Tenant Screening: Implement a rigorous screening process to find reliable tenants who will pay rent on time and take care of the property.

Rental Property Investment Strategies

- Long-Term Rentals: Purchase properties to rent out on a long-term basis, providing stable rental income and potential for property appreciation.

- Airbnb Rentals: Rent out properties on short-term rental platforms like Airbnb for higher rental income, but with more management and turnover costs.

- Section 8 Housing: Participate in the Section 8 Housing program to rent properties to low-income tenants with rental payments partially subsidized by the government.