Diving into the realm of financial planning, we uncover the crucial role it plays in shaping our financial future. Get ready to explore the ins and outs of financial planning and discover why it’s a game-changer for securing your financial well-being.

As we delve deeper, we’ll uncover the key components, risks, investment strategies, retirement plans, and tax implications that come into play in the world of financial planning.

The Concept of Financial Planning

Financial planning is the process of setting goals, evaluating resources, and creating a plan to achieve financial stability and security. It involves analyzing income, expenses, investments, and savings to ensure a secure financial future.

Main Objectives of Financial Planning

- Establishing financial goals: Financial planning helps individuals and families set clear objectives for their financial future, whether it’s buying a home, saving for retirement, or paying off debt.

- Budgeting and managing expenses: Creating a budget and tracking expenses are essential components of financial planning to ensure that individuals live within their means and save for future goals.

- Building an emergency fund: Financial planning emphasizes the importance of having an emergency fund to cover unexpected expenses and financial setbacks, providing a safety net during challenging times.

- Investing wisely: A solid financial plan includes strategies for investing money in avenues that align with long-term financial goals, such as retirement savings or education funds.

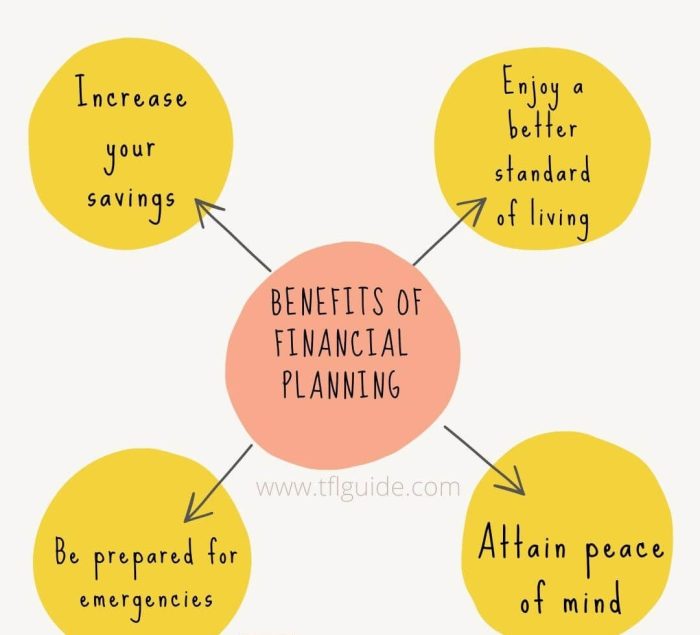

Benefits of Having a Solid Financial Plan

- Peace of mind: Knowing that you have a plan in place to achieve your financial goals can reduce stress and anxiety about money management.

- Financial security: A well-thought-out financial plan can help individuals and families build wealth over time and secure their financial future.

- Improved decision-making: By having a roadmap for your finances, you can make informed decisions about spending, saving, and investing, leading to better financial outcomes.

- Adaptability: A financial plan allows for adjustments in case of unexpected events or changes in financial circumstances, ensuring flexibility in achieving financial goals.

Components of Financial Planning

Financial planning involves several key components that are essential for achieving financial stability and success. These components work together to create a comprehensive plan that helps individuals or businesses manage their finances effectively.

Budgeting

- Budgeting is a crucial aspect of financial planning as it helps individuals or businesses track their income and expenses.

- By creating a budget, one can identify areas where they can save money and allocate funds towards important goals.

- It also allows for better decision-making in terms of spending and helps avoid unnecessary debt or financial strain.

Setting Financial Goals

- Setting financial goals is an important step in financial planning as it provides a clear direction for managing finances.

- Financial goals can be short-term, such as saving for a vacation, or long-term, like retirement planning.

- Having specific goals helps individuals stay motivated and focused on making sound financial decisions.

Risk Management in Financial Planning

Risk management is a crucial aspect of financial planning as it helps individuals mitigate potential losses and protect their assets. By identifying and addressing various types of risks, individuals can make informed decisions to secure their financial future.

Types of Risks

- Market Risk: This type of risk arises from fluctuations in the financial markets, such as changes in interest rates, stock prices, or foreign exchange rates. Diversification and asset allocation are common strategies to manage market risk.

- Credit Risk: Credit risk refers to the possibility of a borrower failing to repay a loan or debt. Lenders often use credit reports and credit scores to assess and manage this risk.

- Interest Rate Risk: Interest rate risk occurs when changes in interest rates impact the value of investments, particularly fixed-income securities like bonds. Duration matching and ladder strategies can help mitigate this risk.

Role of Insurance

Insurance plays a vital role in managing financial risks by providing protection against unforeseen events. Different types of insurance, such as health insurance, life insurance, and property insurance, help individuals transfer specific risks to an insurance company in exchange for premium payments. In the event of a covered loss, insurance can provide financial support and help individuals recover from setbacks.

Investment Planning

Investment planning is a crucial aspect of financial planning as it helps individuals grow their wealth over time by making strategic decisions on where to allocate their funds.

Different Investment Options

- Stocks: Investing in individual company stocks can offer high returns but also comes with higher risks.

- Bonds: Bonds are considered safer investments compared to stocks and provide a fixed income over time.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in real estate can provide rental income and potential appreciation of property value.

Importance of Diversification

Diversification is crucial for a successful investment plan as it helps spread out risk across different asset classes. By diversifying your investments, you reduce the impact of a single investment performing poorly, thus protecting your overall portfolio.

Diversification is the key to managing risk in your investment portfolio.

Retirement Planning

Planning for retirement is essential to ensure financial security and peace of mind during your golden years. It involves setting aside funds to maintain your lifestyle and cover expenses once you stop working.

Importance of Retirement Planning

Retirement planning is crucial as it allows individuals to maintain their standard of living after they stop working. Without proper planning, retirees may face financial hardships and struggle to cover basic expenses. It also helps in avoiding dependency on others for financial support.

- Start Early: The earlier you start saving for retirement, the more time your money has to grow through compound interest.

- Set Clear Goals: Determine how much money you will need in retirement and create a savings plan to reach that goal.

- Utilize Retirement Accounts: Take advantage of employer-sponsored retirement plans like 401(k) or individual retirement accounts (IRAs) to save efficiently.

Strategies for Saving for Retirement

Saving for retirement can be achieved through various strategies that help individuals accumulate the necessary funds to support themselves in their later years.

- Automate Savings: Set up automatic contributions to your retirement accounts to ensure consistent saving.

- Reduce Expenses: Cut down on unnecessary expenses to free up more money for retirement savings.

- Diversify Investments: Spread your investments across different asset classes to minimize risk and maximize returns.

Role of Pensions, Retirement Accounts, and Savings Vehicles

Pensions, retirement accounts, and other savings vehicles play a vital role in retirement planning by providing individuals with dedicated funds to support themselves post-retirement.

Pensions offer a guaranteed income stream during retirement, while retirement accounts like 401(k) and IRAs allow for tax-advantaged savings.

| Pensions | Retirement Accounts | Savings Vehicles |

|---|---|---|

| Provide fixed income post-retirement. | Allow tax-deferred growth of savings. | Include options like CDs, money market accounts, and annuities. |

Tax Planning

Tax planning is a crucial aspect of financial planning as it helps individuals and businesses optimize their tax liabilities, ultimately saving money and maximizing resources for other financial goals.

Significance of Tax Planning

One of the key benefits of tax planning is the ability to legally minimize tax liabilities. By strategically planning ahead and taking advantage of available deductions, credits, and tax-advantaged accounts, individuals can reduce the amount of taxes they owe to the government.

- Utilizing tax deductions such as mortgage interest, charitable donations, and business expenses can help lower taxable income.

- Maximizing contributions to retirement accounts like 401(k)s or IRAs can defer taxes on income until withdrawals are made in retirement.

- Investing in tax-efficient funds or securities can reduce capital gains taxes and enhance overall portfolio returns.

Strategies to Minimize Tax Liabilities

-

Regularly review tax brackets and thresholds to ensure efficient income allocation.

- Utilize tax-loss harvesting to offset capital gains with capital losses in investment portfolios.

- Consider tax-advantaged investment vehicles like municipal bonds or Health Savings Accounts (HSAs) to reduce taxable income.

Tax-Efficient Investing for Financial Goals

Tax-efficient investing involves structuring investment portfolios in a way that minimizes tax implications, allowing individuals to keep more of their investment returns. By focusing on tax-efficient strategies, investors can achieve their financial goals more effectively.

- Choosing tax-advantaged accounts like Roth IRAs or 529 plans for long-term savings goals can provide tax-free growth and withdrawals.

- Investing in index funds or exchange-traded funds (ETFs) with low turnover ratios can reduce capital gains distributions and associated taxes.

- Considering the timing of capital gains realization and utilizing tax-deferral strategies can help manage tax liabilities on investment gains.