Diving into the world of financial planning, this guide is your ticket to mastering the art of creating a solid financial plan. From setting goals to budgeting like a pro, get ready to take control of your finances with swagger and style.

As we delve deeper, you’ll uncover the secrets to financial success and learn how to navigate the complexities of money management with finesse.

Introduction to Financial Planning

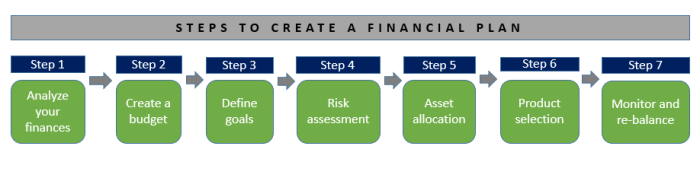

Financial planning is the process of setting goals, evaluating your current financial situation, and creating a roadmap to help you achieve your objectives. It is crucial in managing your money effectively and securing your financial future.

Importance of a Financial Plan

A well-thought-out financial plan provides you with a clear direction on how to manage your finances, helps you make informed financial decisions, and ensures that you are prepared for unexpected expenses or emergencies. It also gives you peace of mind knowing that you are on track to meet your financial goals.

- Ensures financial stability and security

- Helps in achieving short-term and long-term financial goals

- Guides you in making wise investment decisions

- Provides a framework for managing debt and saving for the future

Examples of Financial Goals

Financial planning can help you achieve various goals such as:

- Buying a home

- Saving for retirement

- Starting a business

- Paying off debt

Role of Budgeting in Financial Planning

Budgeting is a critical component of financial planning as it helps you track your income and expenses, identify areas where you can cut costs, and allocate funds towards your financial goals. By creating and sticking to a budget, you can better manage your money and ensure that you are on the right path towards achieving financial success.

Assessing Financial Situation

When it comes to managing your money, the first step is to assess your financial situation. This involves taking a close look at your current financial resources, understanding your net worth, tracking your income and expenses, and utilizing tools or software to help you stay organized.

Creating a Detailed Inventory of Current Financial Resources

Creating a detailed inventory of your current financial resources is essential for understanding where you stand financially. This includes listing all your assets such as savings, investments, properties, and valuable possessions. On the other hand, you should also list all your liabilities like loans, credit card debt, and other financial obligations. By having a clear picture of your assets and liabilities, you can determine your net worth.

Importance of Calculating Net Worth

Calculating your net worth is crucial in understanding your overall financial health. To calculate your net worth, subtract your total liabilities from your total assets. A positive net worth indicates that you have more assets than liabilities, while a negative net worth means you owe more than you own. Tracking your net worth over time can help you assess your financial progress and make informed decisions about your financial goals.

Tracking Income and Expenses

Tracking your income and expenses is key to managing your finances effectively. Start by creating a budget that Artikels your monthly income sources and expenses. By tracking where your money is coming from and where it’s going, you can identify areas where you can cut back on spending and allocate more towards savings or investments. There are various tools and apps available, such as Mint, YNAB (You Need a Budget), and Personal Capital, that can help you track your income and expenses effortlessly.

Tools or Software for Financial Assessment

Utilizing tools or software for financial assessment can simplify the process of managing your finances. In addition to budgeting apps, there are tools like Quicken, QuickBooks, and Excel spreadsheets that can help you track your financial transactions, monitor your net worth, and generate financial reports. These resources can provide valuable insights into your financial situation and assist you in making informed decisions about your money management.

Setting Financial Goals

Setting financial goals is a crucial step in creating a solid financial plan. It involves determining what you want to achieve with your money in the short-term and long-term. By setting clear goals, you can stay motivated and focused on your financial journey.

Short-term and Long-term Financial Goals

- Short-term goals: These are goals you aim to achieve within a year or less, such as building an emergency fund, paying off credit card debt, or saving for a vacation.

- Long-term goals: These are goals that take more than a year to accomplish, like buying a house, saving for retirement, or funding your child’s education.

SMART Criteria for Effective Financial Goals

- Specific: Clearly define your goals, such as saving $10,000 for a down payment on a house.

- Measurable: Make sure your goals are quantifiable, so you can track your progress.

- Achievable: Set realistic goals that you can reach with your current income and resources.

- Relevant: Ensure your goals align with your values and priorities.

- Time-bound: Set a deadline for achieving your goals to create a sense of urgency.

Common Financial Goals

- Saving for retirement: Setting aside a portion of your income for retirement is essential for long-term financial security.

- Buying a home: Owning a home is a common goal for many individuals and families.

- Emergency fund: Building an emergency fund to cover unexpected expenses can provide peace of mind.

Prioritizing and Aligning Goals

- Consider your values: Reflect on what matters most to you and prioritize goals that align with your values.

- Assess your current financial situation: Understand where you stand financially to determine which goals are most pressing.

- Break down big goals: Divide long-term goals into smaller, manageable steps to make progress more achievable.

Creating a Budget

Creating a budget is essential for managing your finances effectively. It involves analyzing your income, expenses, and financial goals to ensure you’re on track with your financial plan.

Different Budgeting Methods

- Zero-based Budgeting: This method requires you to allocate every dollar of your income towards expenses, savings, or investments. By giving every dollar a job, you can maximize your financial resources.

- 50/30/20 Rule: This rule suggests dividing your after-tax income into three categories – 50% for needs, 30% for wants, and 20% for savings or debt repayment. It provides a simple guideline for balancing your spending and saving.

Tracking and Adjusting the Budget

- Track Your Expenses: Keep a record of all your expenses to see where your money is going. This will help you identify areas where you can cut back or make adjustments.

- Review Regularly: Take time to review your budget regularly to ensure you’re staying within your financial goals. Adjust your budget as needed to accommodate any changes in your income or expenses.

Allocating Funds

- Saving: Allocate a portion of your income towards savings to build an emergency fund or save for future goals. Aim to save at least 10-20% of your income.

- Investing: Consider investing a portion of your funds in stocks, bonds, or other investment vehicles to grow your wealth over time. Consult with a financial advisor for guidance.

- Spending: Allocate the remaining portion of your income for your day-to-day expenses, entertainment, and other discretionary spending. Stick to your budget to avoid overspending.

Managing Debt

Managing debt is a crucial aspect of financial planning that involves strategies to effectively reduce and handle debt. It is essential to distinguish between good debt, which can help build wealth, and bad debt, which can lead to financial struggles.

Difference Between Good Debt and Bad Debt

- Good debt is typically used to invest in assets that have the potential to increase in value over time, such as a mortgage for a home or student loans for education.

- On the other hand, bad debt is often used to purchase depreciating assets or non-essential items, such as high-interest credit card debt for luxury items.

Strategies for Managing and Reducing Debt

- One effective strategy is the snowball method, where you pay off your smallest debts first and then move on to larger debts, gaining momentum as you go.

- Another approach is the avalanche method, where you focus on paying off debts with the highest interest rates first to minimize interest payments over time.

Negotiating Lower Interest Rates or Repayment Plans

- Reach out to your creditors to discuss possible options for lowering interest rates or setting up more manageable repayment plans.

- Explain your financial situation and demonstrate your commitment to repaying the debt to increase the chances of a successful negotiation.

Building an Emergency Fund

Having an emergency fund is a crucial part of any financial plan as it provides a safety net for unexpected expenses that may arise.

Determining the Right Amount to Save

It is recommended to save at least 3 to 6 months’ worth of living expenses in your emergency fund. This amount can vary depending on your individual circumstances, such as job stability, health issues, or other factors that may impact your income.

Automating Contributions

One way to ensure consistent contributions to your emergency fund is to set up automatic transfers from your checking account to your savings account. This way, you won’t even have to think about saving for emergencies – it will happen automatically.

Examples of Unexpected Expenses

- Medical emergencies

- Car repairs

- Home maintenance issues

- Job loss

Investing for the Future

Investing for the future is crucial in achieving long-term financial goals. It allows individuals to grow their wealth over time and beat inflation. By investing wisely, one can build a nest egg for retirement, fund their children’s education, or achieve other financial milestones.

Different Investment Options

- Stocks: Investing in stocks means buying shares of ownership in a company. Stocks have the potential for high returns but also come with higher risks.

- Bonds: Bonds are debt securities issued by governments or corporations. They provide a fixed income stream but usually offer lower returns compared to stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer diversification and professional management.

- Real Estate: Investing in real estate involves buying property to generate rental income or capital appreciation. Real estate can provide a steady income stream and potential for long-term growth.

Tips for Diversifying Investment Portfolios

Diversification is key to managing risk in an investment portfolio. By spreading investments across different asset classes and industries, investors can reduce the impact of a single investment’s performance on their overall portfolio. Some tips for diversifying include:

- Allocate investments across different asset classes like stocks, bonds, and real estate.

- Invest in both domestic and international markets to reduce geographic risk.

- Consider investing in different industries to avoid concentration risk.

- Regularly rebalance your portfolio to maintain your desired asset allocation.

Choosing Investments Based on Risk Tolerance and Time Horizon

When selecting investments, it’s crucial to consider your risk tolerance and time horizon. Risk tolerance refers to your ability to withstand market fluctuations, while the time horizon is the length of time you plan to hold an investment. Factors to consider include:

- Aggressive investors may opt for high-risk, high-return investments like stocks.

- Conservative investors may prefer lower-risk options like bonds or real estate.

- Consider your investment goals and how soon you’ll need the money when determining your time horizon.

- Consult with a financial advisor to help you choose investments aligned with your risk tolerance and time horizon.