How to create a budget sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Budgeting is not just about numbers; it’s a tool that can help you take control of your finances and work towards your financial goals. Let’s dive into the world of budgeting and discover how it can transform your financial future.

Understanding Budgeting

Budgeting is the process of creating a plan to manage your money effectively. It involves setting financial goals and outlining how you will allocate your income towards expenses, savings, and investments. Budgeting is crucial for maintaining financial stability and achieving long-term financial success.

Creating a budget is essential for financial planning as it helps you track your income and expenses, identify areas where you can save money, and prioritize your spending based on your goals. Without a budget, it’s easy to overspend, accumulate debt, and struggle to reach important financial milestones.

Importance of Budgeting

- Budgeting helps you stay organized and in control of your finances.

- It allows you to save for emergencies, retirement, or other long-term goals.

- By creating a budget, you can avoid living paycheck to paycheck and reduce financial stress.

- It helps you make informed decisions about your spending habits and financial priorities.

Short-term and Long-term Benefits of Budgeting

- Short-term: Creating a budget can help you pay off debt faster, build an emergency fund, and avoid unnecessary expenses that may lead to financial strain.

- Long-term: Budgeting allows you to plan for major life events like buying a home, starting a family, or retiring comfortably. It also helps you build wealth over time through disciplined saving and investing.

- Overall: Budgeting provides financial security and peace of mind by ensuring that you are prepared for both expected and unexpected expenses.

Setting Financial Goals

Setting financial goals is a crucial step in creating a budget that works for you. It involves identifying what you want to achieve financially and outlining a plan to reach those goals.

Process of Setting Realistic Financial Goals

- Start by determining your short-term and long-term financial objectives. These could include saving for a vacation, buying a home, or planning for retirement.

- Evaluate your current financial situation, including income, expenses, debts, and savings.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your values and priorities.

- Break down larger goals into smaller milestones to track your progress and stay motivated.

Tips for Aligning Budgeting with Financial Objectives

- Regularly review and adjust your budget to ensure it supports your financial goals.

- Allocate a portion of your income towards savings and investments to help you achieve your objectives.

- Avoid unnecessary expenses that do not contribute to your financial goals.

- Seek guidance from a financial advisor or use budgeting tools to stay on track.

Prioritizing Financial Goals in a Budget

- Identify your most important financial goals and allocate funds accordingly. This could mean focusing on debt repayment, emergency savings, or retirement planning.

- Consider the timeline and urgency of each goal to determine the order of priority.

- Be flexible and willing to adjust your budget as circumstances change or new goals arise.

- Regularly monitor your progress towards each goal and celebrate milestones along the way.

Tracking Income and Expenses

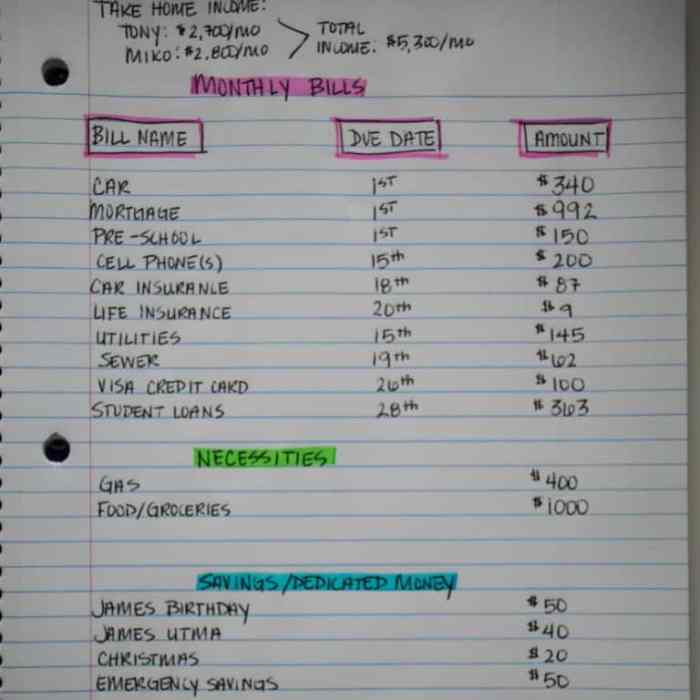

When it comes to creating a budget, tracking your income and expenses is crucial for financial success. By accurately monitoring where your money is coming from and where it’s going, you can make informed decisions to improve your financial situation.

Tracking Income Sources

- Keep track of your primary income sources, such as your salary, freelance work, or any side gigs you have.

- Utilize online tools or apps to automatically track income deposits into your bank account.

- Regularly review your pay stubs or invoices to ensure you are receiving the correct amount.

Types of Expenses to Consider

- Fixed Expenses: These are recurring costs that remain constant each month, such as rent or mortgage payments, insurance premiums, and loan repayments.

- Variable Expenses: These are costs that fluctuate month to month, like groceries, utilities, entertainment, and dining out.

- Unexpected Expenses: Be prepared for unplanned costs like medical emergencies, car repairs, or home maintenance.

Importance of Categorizing Expenses

Categorizing your expenses allows you to see where your money is going and identify areas where you can cut back or reallocate funds. By grouping expenses into categories like housing, transportation, food, and entertainment, you can track your spending patterns and make adjustments to stay within your budget.

Creating a Budget Plan

Creating a detailed budget plan is crucial for managing your finances effectively. By allocating funds for essential expenses, savings, and discretionary spending, you can ensure that you are in control of your money. Here are the steps to create a budget plan:

Allocating Funds

- Start by listing all your sources of income, including your salary, bonuses, and any other earnings.

- Next, calculate your total monthly expenses, including rent or mortgage, utilities, groceries, transportation, and other necessities.

- Allocate a portion of your income to savings, whether it’s for an emergency fund, retirement, or other financial goals.

- After covering essential expenses and savings, allocate the remaining funds for discretionary spending on things like entertainment, dining out, and shopping.

Adjusting the Budget Plan

- Regularly review your budget to ensure that you are staying within your spending limits.

- Be flexible and adjust your budget as needed when financial circumstances change, such as a change in income or unexpected expenses.

- Consider reallocating funds from one category to another to accommodate changes in your financial situation.

- Seek ways to increase your income or decrease expenses if you find it challenging to stick to your budget.

Implementing Budgeting Tools

Implementing budgeting tools can greatly enhance your financial planning process and help you stay on track with your goals. Utilizing budgeting apps or software can offer numerous benefits, such as real-time tracking of expenses, automatic categorization of transactions, and customizable budget categories.

Comparison of Budgeting Tools

- Mint: A popular free budgeting app that syncs with your accounts to track spending and create budgets.

- YNAB (You Need a Budget): Focuses on giving every dollar a job and helps users prioritize their spending.

- Personal Capital: Not only tracks spending but also offers investment tools for holistic financial planning.

- EveryDollar: Developed by Dave Ramsey, this app follows a zero-based budgeting approach to ensure every dollar is allocated.

Selecting the Right Budgeting Tool

- Consider your budgeting style: Choose a tool that aligns with your preferred budgeting method, whether it’s zero-based budgeting or a more flexible approach.

- Features and functionality: Look for tools that offer features like goal tracking, debt payoff calculators, and customizable reports to suit your needs.

- Cost: While many budgeting apps are free, some may have premium features that require a subscription. Evaluate the cost versus the benefits you’ll receive.

- User interface: Opt for a tool with an interface that is intuitive and easy to navigate to ensure you’ll actually use it consistently.