Get ready to dive deep into the world of high-volatility stock trading – where risks are high, but so are the potential rewards. This introduction sets the stage for an exhilarating journey into the fast-paced realm of trading high-volatility stocks.

As we explore the strategies, risks, risk management techniques, and tools involved in high-volatility stock trading, you’ll gain valuable insights into this dynamic and exciting market.

Overview of High-Volatility Stock Trading

High-volatility stock trading involves buying and selling stocks that experience significant price fluctuations within a short period of time. These stocks are known for their rapid and unpredictable price movements, presenting both opportunities and risks for traders.

Why High-Volatility Stocks are Attractive to Traders

High-volatility stocks are attractive to traders because they offer the potential for substantial profits in a short amount of time. Traders can capitalize on the price swings to make quick gains, especially in volatile market conditions. Additionally, high-volatility stocks can provide exciting trading opportunities for those who thrive on risk and adrenaline.

Risks Associated with High-Volatility Stock Trading

Trading high-volatility stocks comes with significant risks. The rapid price movements can lead to substantial losses if the trader is on the wrong side of the trade. Additionally, the volatile nature of these stocks can make it challenging to predict price movements accurately, increasing the risk of making poor trading decisions. It is essential for traders to have a solid risk management strategy in place to mitigate the potential losses associated with high-volatility stock trading.

Strategies for High-Volatility Stock Trading

When it comes to trading high-volatility stocks, having a solid strategy is crucial for success. There are several common strategies that traders use to navigate the ups and downs of these volatile markets. Let’s take a closer look at some of these strategies and how they differ based on the trading timeframe.

Short-Term vs. Long-Term Trading Strategies

Short-term trading strategies in high-volatility stock markets often involve taking advantage of quick price movements to make profits in a short period. Traders who use short-term strategies may rely on technical analysis, such as chart patterns and indicators, to make rapid trading decisions.

On the other hand, long-term trading strategies focus on holding onto stocks for an extended period, despite the market’s volatility. These strategies may involve fundamental analysis, looking at a company’s financial health and growth prospects to determine the long-term potential of a stock.

Examples of Successful Trading Strategies

- Momentum Trading: This strategy involves buying stocks that are trending upwards in high-volatility markets, with the expectation that the trend will continue.

- Contrarian Trading: Contrarian traders go against the market sentiment, buying stocks that are undervalued or selling overvalued stocks in anticipation of a market correction.

- Options Trading: Options can be useful in high-volatility markets, allowing traders to hedge their positions or speculate on price movements without owning the underlying stock.

Risk Management in High-Volatility Stock Trading

In the world of high-volatility stock trading, risk management is crucial to protect your investments and maximize profits. By implementing effective risk management strategies, you can navigate the unpredictable nature of volatile stocks and minimize potential losses.

Importance of Risk Management

Managing risk in high-volatility stock trading is essential to safeguard your capital and prevent significant financial setbacks. Without proper risk management, you could expose yourself to excessive losses and jeopardize your overall trading portfolio.

Techniques for Managing Risk

- Set Stop-Loss Orders: Implement stop-loss orders to automatically sell a stock at a predetermined price to limit losses.

- Diversify Your Portfolio: Spread your investments across different stocks and sectors to reduce risk exposure.

- Use Position Sizing: Determine the appropriate position size based on your risk tolerance and the volatility of the stock.

- Monitor Market Conditions: Stay informed about market trends and news that could impact the volatility of your stocks.

Tips for Minimizing Losses

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Practice Patience: Be patient and wait for the right opportunities to enter or exit trades, avoiding unnecessary risks.

- Educate Yourself: Continuously educate yourself about high-volatility trading strategies and techniques to make informed decisions.

- Limit Leverage: Avoid excessive leverage that can amplify losses in volatile market conditions.

Tools and Resources for High-Volatility Stock Trading

When it comes to trading high-volatility stocks, having the right tools and resources at your disposal can make a significant difference in your success. These tools can help you analyze market trends, make informed decisions, and manage risks effectively.

Essential Tools and Resources for Analyzing High-Volatility Stocks

- Stock Screener: A tool that allows you to filter stocks based on specific criteria such as price, volume, and volatility.

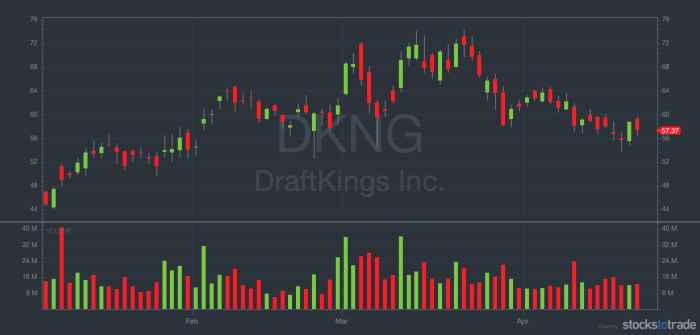

- Technical Analysis Software: Platforms like TradingView or Thinkorswim provide advanced charting tools for analyzing price movements and identifying patterns.

- Real-Time News Feeds: Access to up-to-date news and market information can help you stay informed about events that may impact stock prices.

- Volatility Indicators: Tools like Bollinger Bands or Average True Range (ATR) can help you gauge the level of volatility in the market.

How Technical Analysis Can be Used in High-Volatility Stock Trading

Technical analysis involves studying past market data, primarily price and volume, to predict future price movements. In high-volatility stock trading, technical analysis can help traders identify key support and resistance levels, trend reversals, and potential entry and exit points.

The Role of News and Market Sentiment in Trading High-Volatility Stocks

Market sentiment, driven by news events and investor emotions, plays a crucial role in high-volatility stock trading. Positive or negative news can lead to sharp price movements in volatile stocks, making it essential for traders to stay updated with market news and sentiment to make informed trading decisions.