Ready to dive into the world of hedge funds for beginners? Buckle up as we explore the ins and outs of this unique investment opportunity. From understanding the basics to uncovering strategies of well-known funds, this guide will have you navigating the financial landscape like a pro in no time.

Introduction to Hedge Funds

Hedge funds are alternative investment vehicles that differ from traditional investment funds in terms of flexibility, strategies, and regulations.

Unlike mutual funds, hedge funds are typically only open to accredited investors and have fewer restrictions on the types of investments they can make.

Basic Structure of a Hedge Fund

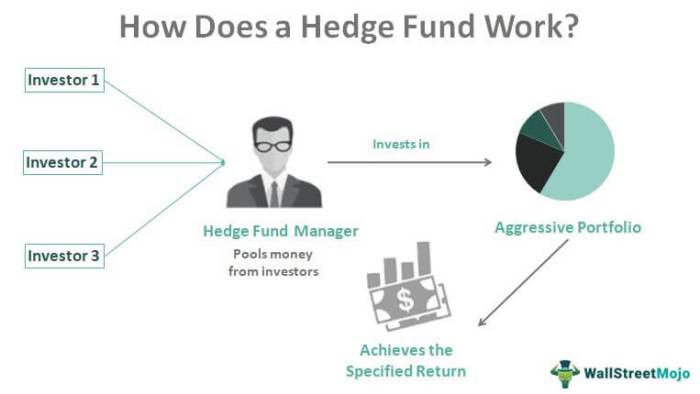

- Hedge funds are managed by professional fund managers who aim to generate high returns by using a variety of investment strategies.

- Investors in hedge funds typically pay a management fee and a performance fee based on the fund’s profits.

- Hedge funds often use leverage and derivatives to amplify returns, but this also increases the risk of losses.

Key Characteristics of Hedge Funds

- Hedge funds often have high minimum investment requirements and are only open to accredited investors.

- They have the flexibility to invest in a wide range of assets, including stocks, bonds, commodities, and derivatives.

- Hedge funds use a variety of strategies, such as long/short, event-driven, and global macro, to generate returns in different market conditions.

Examples of Well-Known Hedge Funds and Their Strategies

- Bridgewater Associates: Known for its macroeconomic approach, Bridgewater Associates focuses on global trends and economic indicators to make investment decisions.

- Renaissance Technologies: Utilizing quantitative trading strategies, Renaissance Technologies has achieved impressive returns by analyzing large datasets and identifying patterns.

- Paulson & Co.: Paulson & Co. gained fame for its bets against subprime mortgages during the 2008 financial crisis, resulting in significant profits for the fund.

Benefits and Risks of Hedge Funds

Investing in hedge funds can offer beginners several potential benefits. Hedge funds are known for their ability to generate higher returns than traditional investment options like mutual funds. They often employ sophisticated strategies such as short selling, leverage, and derivatives to maximize profits. Additionally, hedge funds are managed by experienced professionals who aim to outperform the market, providing investors with the opportunity to earn above-average returns.

Potential Benefits of Hedge Funds:

- Hedge funds have the potential to generate higher returns compared to traditional investments.

- Experienced fund managers use complex strategies to capitalize on market inefficiencies and generate profits.

- Investing in hedge funds can provide diversification benefits by adding a non-correlated asset to a portfolio.

- Some hedge funds offer opportunities to invest in unique asset classes or markets that are not accessible through traditional investments.

Risks Associated with Hedge Fund Investments:

- Hedge funds often charge higher fees than other investment options, reducing overall returns for investors.

- Due to the use of leverage and derivatives, hedge funds can be more volatile and subject to significant fluctuations in value.

- Investments in hedge funds are typically illiquid, meaning that investors may have limited ability to withdraw their funds on short notice.

- Some hedge funds may engage in aggressive or risky strategies that can result in substantial losses for investors.

Diversification Benefits of Hedge Funds:

- Adding hedge funds to a portfolio can help reduce overall risk by including assets that do not move in tandem with traditional investments.

- Hedge funds often have low correlation to stock and bond markets, providing a hedge against market downturns.

- By diversifying into hedge funds, beginners can potentially enhance risk-adjusted returns and improve the overall performance of their investment portfolio.

How to Invest in Hedge Funds

Investing in hedge funds can be a lucrative opportunity for those looking to diversify their portfolio and potentially earn higher returns. Here’s a breakdown of how beginners can get started in investing in hedge funds:

Different Ways to Invest in Hedge Funds

- Direct Investment: You can invest directly in a hedge fund by meeting the minimum investment requirements set by the fund. This usually involves a substantial amount of capital, often ranging from $100,000 to $1 million.

- Indirect Investment: Another way to invest in hedge funds is through hedge fund of funds, which pool investors’ money and invest in a portfolio of different hedge funds. This allows for diversification and lower minimum investment requirements.

Minimum Investment Requirements

Minimum investment requirements for hedge funds can vary widely depending on the fund’s strategy, size, and exclusivity. Some hedge funds may require a minimum investment of $100,000, while others may have minimums in the millions. It’s essential to research and understand the specific requirements of each fund before investing.

Role of Hedge Fund Managers

Hedge fund managers play a crucial role in the investment process, as they are responsible for making investment decisions, managing risk, and executing the fund’s strategy. Their expertise and track record are key factors to consider when choosing a hedge fund to invest in. It’s important to research the background and performance of the fund manager to ensure they have a solid reputation and are aligned with your investment goals.

Performance Measurement and Evaluation

When it comes to hedge funds, understanding how to measure and evaluate their performance is crucial for investors. By analyzing different performance metrics and considering past performance, investors can make informed decisions about where to put their money.

Performance Metrics Used in Hedge Funds

- Sharpe Ratio: This metric measures the risk-adjusted return of a hedge fund. A higher Sharpe Ratio indicates better performance.

- Alpha: Alpha represents the excess return of a fund compared to its benchmark. A positive alpha suggests the fund outperformed its benchmark.

- Beta: Beta measures the fund’s volatility compared to the market. A beta of 1 indicates the fund moves in line with the market.

Importance of Understanding Past Performance

Looking at a hedge fund’s past performance can provide valuable insights into how it may perform in the future. It allows investors to evaluate the fund’s track record, consistency, and risk management strategies.

Regulation and Oversight of Hedge Funds

When it comes to hedge funds, regulation and oversight play a crucial role in protecting investors and ensuring the stability of the financial system. Let’s delve into the regulatory environment surrounding hedge funds and its impact on investors.

Regulatory Environment

Hedge funds are subject to regulations set forth by various regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States. These regulations aim to safeguard investors by imposing certain restrictions and requirements on hedge funds.

- Regulations often dictate the types of investments hedge funds can make, the amount of leverage they can use, and the disclosure requirements they must adhere to.

- Investors benefit from these regulations as they provide a level of transparency and oversight that helps them make informed investment decisions.

- Regulatory requirements also help mitigate risks associated with hedge funds and prevent fraudulent activities that could harm investors.

Role of Regulatory Bodies

Regulatory bodies play a crucial role in overseeing hedge fund activities to ensure compliance with regulations and protect investors’ interests.

- The SEC in the U.S. conducts examinations and investigations to monitor hedge funds’ compliance with regulations and identify any potential violations.

- Other regulatory bodies around the world, such as the Financial Conduct Authority (FCA) in the UK, also oversee hedge fund activities to maintain market integrity and investor protection.

- Regulatory bodies work to enforce rules and regulations that promote fair and transparent markets, fostering investor confidence in the hedge fund industry.

Transparency and Reporting Requirements

Transparency and reporting requirements are essential aspects of hedge fund regulation that aim to provide investors with the necessary information to make informed decisions.

- Hedge funds are often required to disclose information about their investment strategies, performance, fees, and risks to investors through periodic reports and filings.

- Transparency helps investors understand how hedge funds operate and the potential risks and rewards associated with investing in them.

- Reporting requirements also help regulatory bodies monitor hedge fund activities and ensure compliance with regulations, contributing to market stability and investor protection.