Diving into Financial literacy for kids, this introduction immerses readers in a unique and compelling narrative. Get ready to explore the world of money management and financial education tailored for children.

From teaching basic concepts to understanding the importance of saving and investing, this guide will equip parents and educators with essential tools to help kids navigate the financial landscape confidently.

Introduction to Financial Literacy for Kids

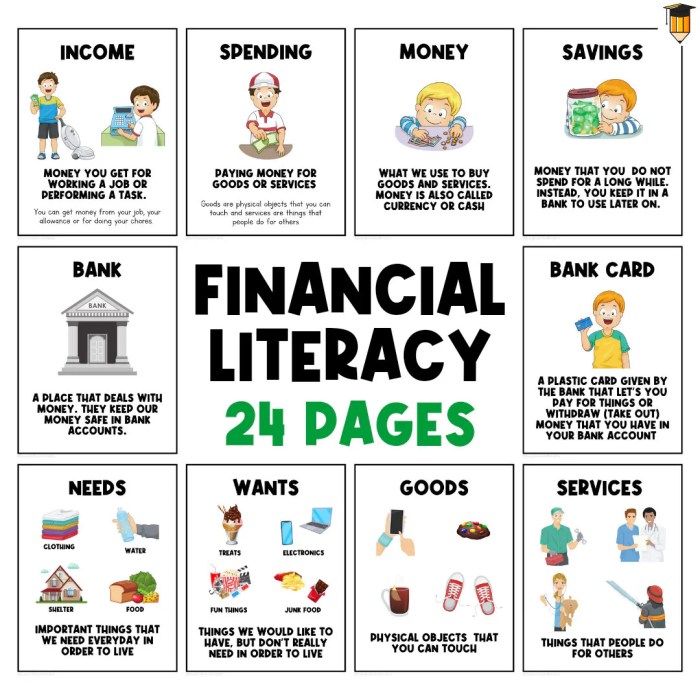

Financial literacy for kids means teaching them about money management skills from an early age. It involves educating children on how to earn, save, spend, and invest money wisely.

It is important to teach kids about money management because it sets a strong foundation for their future financial well-being. By instilling good financial habits early on, children can develop a better understanding of the value of money and how to make smart financial decisions.

Benefits of Early Financial Education for Children

- Teaches the importance of saving: Kids learn the value of saving money for future goals and emergencies.

- Encourages responsible spending: Children understand the difference between needs and wants, helping them make informed spending choices.

- Introduces basic investing concepts: Kids can learn about the power of compound interest and how investing can help grow their money over time.

- Promotes financial independence: Early financial education empowers kids to take control of their finances and make informed decisions.

Basic Concepts of Financial Literacy

Financial literacy for kids involves understanding key concepts like saving, budgeting, and spending wisely. Teaching these principles early on can set children up for a lifetime of financial success.

Saving Money

- Encourage kids to save a portion of their allowance or earnings in a piggy bank or savings account.

- Set savings goals for items they want to purchase in the future.

- Teach the importance of delayed gratification and how saving now can lead to bigger rewards later.

Budgeting

- Show children how to create a simple budget by tracking their income and expenses.

- Help them differentiate between needs and wants to prioritize spending.

- Involve kids in family budget discussions to learn real-life money management skills.

Spending Wisely

- Teach kids to comparison shop and look for deals to make their money go further.

- Discuss impulse buying and how to avoid unnecessary purchases.

- Encourage thoughtful spending by considering value and quality before making a purchase.

Setting financial goals early on can help kids develop good money habits and work towards achieving their dreams.

Tools and Resources for Teaching Financial Literacy

Teaching kids about financial literacy can be made fun and engaging with the help of various educational tools, games, and apps specifically designed for this purpose. By integrating these resources effectively, parents and educators can instill valuable money management skills in children from a young age.

Educational Tools

- Money Savvy Pig: A physical piggy bank that teaches children about saving, spending, donating, and investing through different compartments.

- Bankaroo: An online virtual bank that helps kids track their allowance, set savings goals, and learn about budgeting.

- Cha-Ching: A series of music videos, games, and activities that teach kids about earning, saving, spending, and donating money responsibly.

Games

- Monopoly: A classic board game that teaches kids about buying, selling, and investing in properties while managing money.

- MarketWatch Virtual Stock Exchange: An online game that simulates stock market trading to help kids understand investing and financial markets.

- Count on Pablo: A game that teaches basic math skills and financial literacy through interactive gameplay.

Apps

- Green$treets: A mobile app that teaches kids about money management, budgeting, and making environmentally friendly choices.

- PiggyBot: An allowance tracking app that helps kids set savings goals, track spending, and learn about financial responsibility.

- Renegade Buggies: An app that combines entertainment with financial literacy by teaching kids about budgeting and decision-making in a fun way.

Importance of Saving and Investing

Saving money is a crucial financial habit that kids should start early on. It involves setting aside a portion of your income for future use, emergencies, or to achieve specific financial goals. Teaching children the importance of saving can help instill a sense of responsibility and discipline when it comes to managing their finances.

Simple Ways to Start Saving

- Encourage kids to save a portion of their allowance or any money they receive as gifts.

- Set up a piggy bank or a savings account where they can deposit their savings regularly.

- Teach them to differentiate between needs and wants to prioritize saving for important expenses.

Benefits of Early Saving Habits

- Develops good money management skills and financial responsibility.

- Helps children understand the value of money and the importance of setting financial goals.

- Creates a financial safety net for unexpected expenses or emergencies.

Introduction to Investing

Investing is the process of putting your money into financial assets with the expectation of generating returns over time. While saving is essential, investing allows your money to grow and work for you in the long run. Teaching children about investing at an early age can set them up for long-term financial success.

Importance of Investing for Long-Term Growth

- Investing can help beat inflation and increase the purchasing power of money over time.

- Provides the opportunity to build wealth and achieve financial goals such as buying a home, funding education, or retiring comfortably.

- Teaches the concept of delayed gratification and the benefits of long-term financial planning.

Teaching Kids about Budgeting and Spending

Teaching kids about budgeting and spending is crucial to help them develop financial responsibility from a young age. By instilling these skills early on, children can learn the value of money and make informed decisions about their finances.

Strategies to Teach Children about Budgeting Their Money

- Encourage children to set financial goals, such as saving for a specific toy or game.

- Teach them to track their expenses and income using a simple budgeting tool or app.

- Involve children in family budget discussions to help them understand how money is allocated for different expenses.

- Provide opportunities for children to earn money through chores or a small business to teach them the importance of earning and managing money.

The Importance of Distinguishing Needs from Wants When Spending

- Needs are essential items required for survival, such as food, clothing, and shelter.

- Wants are non-essential items that are nice to have but not necessary for survival, such as toys, games, or luxury items.

- Teach children to prioritize needs over wants when making spending decisions to ensure they allocate their money wisely.

Practical Tips on How Parents Can Help Kids Develop Responsible Spending Habits

- Set a good example by demonstrating responsible spending and saving habits in front of your children.

- Encourage open discussions about money and financial decisions to help children feel comfortable talking about finances.

- Provide opportunities for children to make spending decisions and learn from their mistakes in a safe environment.

- Teach children to comparison shop and look for deals to make the most of their money.

Real-Life Examples and Case Studies

Financial literacy skills are crucial for children to develop from a young age. Here are some real-life examples and case studies showcasing how kids have successfully managed their money and the impact of financial literacy on their future financial well-being.

Case Study 1: Alex’s Savings Goal

- Alex, a 10-year-old, set a goal to save $100 from his allowance over the summer.

- He tracked his expenses, avoided unnecessary purchases, and saved a portion of his weekly allowance.

- By the end of the summer, Alex not only reached his goal but also learned the importance of saving for future needs.

Case Study 2: Emily’s Entrepreneurial Spirit

- Emily, a 12-year-old, started a small business selling handmade jewelry to her classmates.

- She kept detailed records of her earnings, expenses, and profits, learning valuable lessons about budgeting and managing cash flow.

- Through her business, Emily not only earned money but also developed essential financial skills that will benefit her in the future.

Impact of Financial Literacy on Children’s Future

Teaching kids about financial literacy early on can have a lasting impact on their future financial well-being. By instilling good money habits and skills from a young age, children are better equipped to make informed financial decisions, save for the future, and avoid debt traps.