Dive into the world of finance management apps where tracking expenses, setting budgets, and accessing real-time financial data become a breeze. Get ready to revolutionize the way you manage your finances with just a few taps and swipes.

Whether you’re a budgeting newbie or a seasoned financial pro, these apps offer a range of features to suit your needs and help you take control of your money like never before.

Benefits of using finance management apps

Finance management apps offer numerous benefits to users, helping them take control of their finances and make informed decisions about their money. These apps assist in tracking expenses, budgeting effectively, and providing real-time financial data for better financial planning.

Tracking Expenses

- Finance management apps allow users to easily track their expenses by categorizing transactions, providing detailed reports, and setting spending limits.

- Users can input their expenses manually or sync the app with their bank accounts for automatic tracking, ensuring all transactions are accounted for.

Budgeting Assistance

- These apps help users create and stick to budgets by setting financial goals, creating spending categories, and receiving alerts for overspending.

- Users can visualize their spending habits through charts and graphs, making it easier to identify areas where they can cut back and save money.

Real-Time Financial Data

- One of the key benefits of finance management apps is the ability to access real-time financial data, such as account balances, income, and expenses.

- This up-to-date information allows users to make immediate financial decisions, track their progress towards financial goals, and adjust their spending habits as needed.

Features to look for in finance management apps

When choosing a finance management app, it’s important to consider the key features that will help you effectively manage your finances. These features can make a significant difference in how well you can track your expenses, create budgets, and stay on top of bill payments. Additionally, security features are crucial to protect your sensitive financial information and ensure that your data is safe from unauthorized access.

Expense Tracking

- Real-time tracking of expenses across different categories

- Ability to manually input expenses or automatically sync with bank accounts

- Visual representation of spending patterns through graphs and charts

Budgeting Tools

- Customizable budget categories and spending limits

- Alerts and notifications for approaching budget limits

- Ability to set financial goals and track progress towards them

Bill Payment Reminders

- Scheduled reminders for upcoming bills and due dates

- Option to link bill payment accounts for automatic payments

- Notification alerts for overdue bills to avoid late fees

Security Features

- Data encryption to protect sensitive financial information

- Multi-factor authentication for added login security

- Regular software updates to address security vulnerabilities

Syncing Capabilities

- Seamless syncing with bank accounts and credit cards for real-time updates

- Ability to categorize transactions and reconcile with bank statements

- Support for multiple financial institutions to manage all accounts in one place

Popular finance management apps in the market

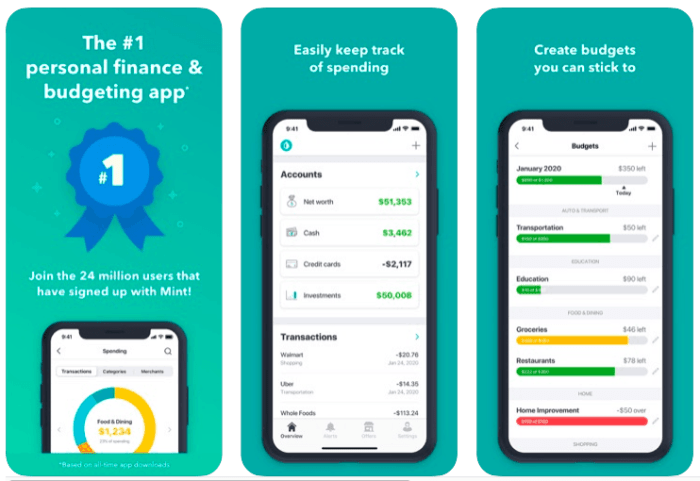

Finance management apps have gained popularity in recent years due to their ability to help users track their expenses, manage budgets, and plan for the future. Some well-known finance management apps in the market include Mint, YNAB (You Need a Budget), and Personal Capital.

User Interfaces and User Experience

When it comes to user interfaces, Mint is known for its clean and intuitive design, making it easy for users to navigate and access their financial information. YNAB, on the other hand, has a more minimalist approach with a focus on budgeting and goal setting. Personal Capital offers a more comprehensive view of your finances, including investments and retirement accounts.

User Reviews and Ratings

According to reputable sources like the App Store and Google Play Store, Mint has consistently high ratings, with users praising its ease of use and budgeting tools. YNAB is also highly rated for its proactive approach to budgeting and debt management. Personal Capital, known for its investment tracking features, has received positive reviews for its ability to help users plan for retirement and analyze their investment portfolios.

Tips for maximizing the benefits of finance management apps

Using finance management apps can be a game-changer for your financial well-being. Here are some tips to help you make the most out of these apps:

Setting Achievable Financial Goals

One of the key features of finance management apps is the ability to set and track your financial goals. To make the most of this feature, start by defining clear and achievable goals. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, setting specific goals will help you stay motivated and on track.

Creating and Sticking to a Budget

Finance management apps make it easier than ever to create and stick to a budget. Start by tracking your income and expenses to get a clear picture of your financial situation. Use the budgeting tools in the app to allocate funds for different categories like groceries, entertainment, and savings. Set realistic spending limits and regularly monitor your progress to ensure you’re staying within your budget.

Using Reports and Insights for Financial Planning

Take advantage of the reports and insights generated by finance management apps to inform your financial planning decisions. These tools can provide valuable information on your spending patterns, saving habits, and areas where you can cut back. Use this data to identify opportunities for improvement and make informed decisions about your financial future.