With credit utilization ratio at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Credit utilization ratio, a key factor in determining creditworthiness, plays a vital role in shaping your financial health. Understanding how this ratio works can be the key to unlocking better credit opportunities.

What is Credit Utilization Ratio?

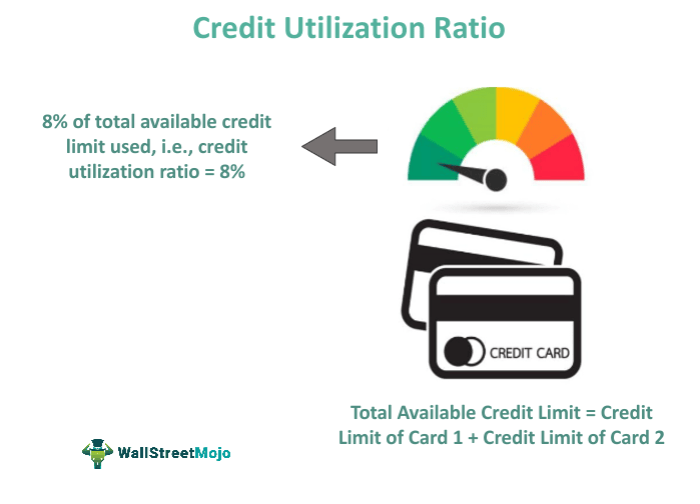

Credit utilization ratio is a key factor in determining your creditworthiness and is the percentage of available credit that you are currently using.

Calculation of Credit Utilization Ratio

To calculate your credit utilization ratio, divide the total amount of credit you are currently using by the total amount of credit available to you. Multiply the result by 100 to get the percentage.

Importance of Credit Utilization Ratio for Credit Scores

Your credit utilization ratio is important for your credit score because it shows how responsibly you manage your credit. A lower credit utilization ratio indicates that you are using your credit wisely and not maxing out your available credit.

Impact of Credit Utilization Ratio on Creditworthiness

- A high credit utilization ratio can negatively impact your credit score, as it may indicate financial stress or inability to manage credit responsibly.

- Lenders prefer to see a credit utilization ratio of 30% or lower, as it shows that you are not overly reliant on credit and can manage your finances effectively.

- Lowering your credit utilization ratio by paying down balances can improve your credit score and increase your chances of being approved for loans or credit cards.

Factors Affecting Credit Utilization Ratio

Understanding the factors that influence credit utilization ratio is essential for managing your credit effectively. Let’s explore how credit limits, balances, and new credit accounts impact this important financial metric.

Credit Limits and Balances

Maintaining a low credit utilization ratio involves keeping your balances well below your credit limits. Ideally, you should aim to use only a small percentage of your available credit. For example, if you have a credit limit of $10,000, keeping your balance around $1,000 or less can help you achieve a low utilization ratio. Remember, the lower the ratio, the better it is for your credit score.

Opening New Credit Accounts

When you open new credit accounts, it can affect your credit utilization ratio in a couple of ways. Firstly, the new credit account will increase your total available credit, potentially lowering your overall ratio. However, if you start using this new credit immediately, it can also increase your total balance, leading to a higher utilization ratio. It’s essential to be mindful of these changes and manage your credit usage wisely.

Tips for Managing Factors Affecting Credit Utilization Ratio

– Regularly monitor your credit balances and credit limits to ensure you are staying within a healthy utilization ratio.

– Avoid closing old credit accounts, as this can reduce your total available credit and potentially increase your utilization ratio.

– Consider requesting a credit limit increase on existing accounts to help lower your utilization ratio, but be cautious not to overspend just because you have a higher limit.

– Paying off credit card balances in full and on time each month can significantly improve your credit utilization ratio over time.

Importance of Maintaining a Low Credit Utilization Ratio

Maintaining a low credit utilization ratio is crucial for your financial well-being. This ratio represents the amount of credit you are currently using compared to the total credit available to you. Keeping this ratio low shows lenders that you are not overly reliant on credit, which can positively impact your credit score.

Benefits of a Low Credit Utilization Ratio

- Improves Credit Scores: A low credit utilization ratio indicates responsible credit usage, leading to higher credit scores. Lenders view this as a positive sign and are more likely to offer favorable terms on loans and credit cards.

- Lower Interest Rates: With a low credit utilization ratio, you may qualify for lower interest rates on new credit accounts, saving you money in the long run.

- Higher Credit Limits: Maintaining a low ratio can also result in credit card companies increasing your credit limits, giving you more financial flexibility.

Strategies to Maintain a Low Credit Utilization Ratio

- Pay Balances in Full: Aim to pay off your credit card balances in full each month to keep your credit utilization ratio low.

- Monitor Spending: Keep track of your spending habits and try to stay well below your credit limits to avoid high utilization.

- Request Credit Limit Increases: Contact your credit card issuer to request a credit limit increase, which can help lower your utilization ratio.

Examples of How a Low Credit Utilization Ratio Benefits Financial Health

- John maintains a low credit utilization ratio of 10% by paying off his credit card balances in full each month. As a result, he has a high credit score and qualifies for a mortgage with a low interest rate.

- Sarah regularly monitors her spending and keeps her credit utilization ratio below 20%. This responsible behavior allows her to secure a new car loan at a favorable rate.

Impact of High Credit Utilization Ratio

Having a high credit utilization ratio can have serious consequences on your financial health. When you use a large portion of your available credit, it can signal to lenders that you may be overextended and struggling to manage your finances effectively. This can lead to a negative impact on your creditworthiness and potentially lower credit scores.

Consequences of High Credit Utilization Ratio

- Increased interest rates on loans and credit cards

- Difficulty qualifying for new credit

- Negative impact on credit scores

- Potential denial of loan applications

Addressing High Credit Utilization Ratio

- Pay down existing credit card balances

- Avoid closing unused credit accounts

- Request a credit limit increase on existing cards

- Consider a balance transfer to a card with a lower interest rate

Tips for Reducing High Credit Utilization Ratio

- Set up automatic payments to ensure on-time payments

- Avoid maxing out credit cards

- Create a budget to track your spending and prioritize debt repayment

- Monitor your credit utilization ratio regularly and make adjustments as needed