Diving into the world of Budgeting for small businesses, we uncover the secrets to financial stability and growth in the business realm. Stay tuned as we explore the ins and outs of budgeting for small enterprises, unlocking the path to long-term success and prosperity.

In the following paragraphs, we’ll delve into the importance of budgeting, creating effective budgets, tracking expenses and revenue, and planning for growth and expansion in the small business landscape.

Importance of Budgeting for Small Businesses

Budgeting is crucial for the financial health of small businesses as it helps in planning and managing finances effectively. Without a budget, small businesses may struggle to control expenses, allocate resources efficiently, and make informed financial decisions. Here are some reasons why budgeting is essential for small businesses:

Effective Planning and Goal Achievement

- Setting clear financial goals: Budgeting helps small businesses set achievable financial goals and create a roadmap to reach them.

- Resource allocation: By creating a budget, small businesses can allocate resources such as funds, time, and manpower strategically to maximize productivity and profitability.

- Identifying financial trends: Through budgeting, small businesses can analyze past financial data to identify trends, make forecasts, and adjust their strategies accordingly.

Consequences of Not Having a Budget

- Financial instability: Without a budget, small businesses may face cash flow problems, overspending, or insufficient funds to cover expenses, leading to financial instability.

- Lack of direction: The absence of a budget can result in a lack of direction and clarity in financial decision-making, hindering the business’s growth and success.

- Inability to measure performance: Without a budget, small businesses cannot track their financial performance, assess their progress towards goals, or make data-driven adjustments to improve profitability.

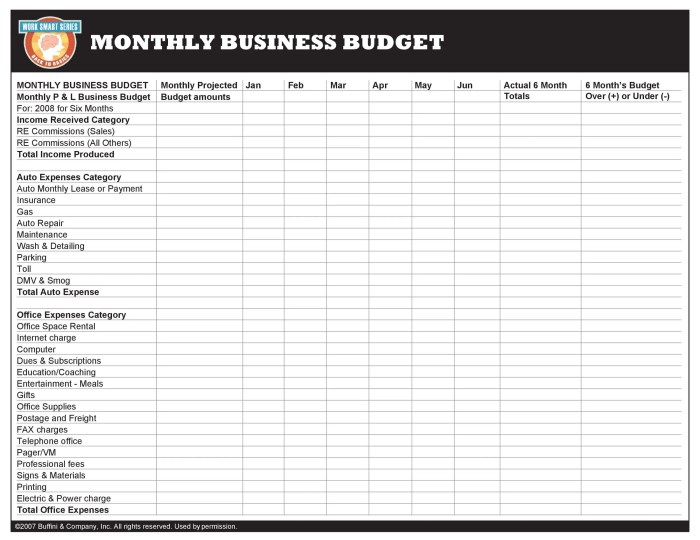

Creating a Budget for Small Businesses

Creating a budget for a small business is crucial for financial planning and decision-making. It involves careful consideration of income, expenses, and financial goals. Here are the steps involved in creating a budget for a small business:

Identify Income Sources

- List all sources of income, including sales revenue, investments, and loans.

- Estimate the amount of income expected from each source based on past performance and future projections.

Determine Fixed and Variable Expenses

- Differentiate between fixed expenses (rent, utilities) and variable expenses (inventory, marketing).

- Assign specific amounts to each expense category based on historical data and future needs.

Set Financial Goals

- Establish short-term and long-term financial goals for the business.

- Allocate funds in the budget to achieve these goals, whether it’s expanding operations or increasing profitability.

Choose a Budgeting Method

There are various budgeting methods that small businesses can use, such as:

- Traditional Budgeting: Based on historical data and incremental changes.

- Zero-Based Budgeting: Requires justifying every expense from zero, promoting cost efficiency.

- Activity-Based Budgeting: Focuses on activities that drive costs, providing a more detailed view of expenses.

- Variance Analysis: Compares budgeted amounts with actual results to identify discrepancies and make adjustments.

Compare and Contrast Budgeting Approaches

- Traditional Budgeting: Relies on past data and may not adapt well to changing business environments.

- Newer Methods: Emphasize flexibility, accuracy, and alignment with strategic goals, but may require more resources to implement.

Tracking Expenses and Revenue

Effective tracking of expenses and revenue is crucial for the financial health of small businesses. By closely monitoring financial data, businesses can make informed decisions and ensure that they stay within their budget constraints.

Tips for Tracking Expenses and Revenue

- Utilize accounting software: Investing in accounting software like QuickBooks or FreshBooks can help streamline the tracking process and provide detailed reports on expenses and revenue.

- Keep detailed records: Maintain organized records of all expenses and revenue sources to easily track where money is coming from and where it is going.

- Set up regular check-ins: Schedule weekly or monthly reviews of financial data to identify any discrepancies or areas where adjustments may be needed.

- Categorize expenses: Create specific categories for expenses to better understand where money is being spent and identify areas where costs can be reduced.

Tools and Software for Tracking Expenses and Revenue

- QuickBooks: A popular accounting software that offers features for tracking expenses, generating reports, and managing invoices.

- FreshBooks: Another accounting software option that simplifies expense tracking and provides insights into revenue streams.

- Expensify: An expense management tool that allows users to scan receipts, track mileage, and create expense reports for better financial tracking.

- Wave: A free accounting software that includes features for tracking expenses, managing invoices, and monitoring cash flow.

Budgeting for Growth and Expansion

As small businesses look to expand and grow, budgeting plays a crucial role in ensuring that resources are allocated effectively. By planning ahead and setting aside funds for growth opportunities, businesses can position themselves for success in the long term.

Allocating Funds for Scaling

When it comes to allocating funds for scaling the business, small businesses can consider the following strategies:

- Identify key areas for growth: Determine which aspects of the business have the most potential for expansion and allocate funds accordingly.

- Set clear goals: Establish specific growth targets and create a budget that aligns with these objectives.

- Invest in marketing and advertising: Allocate funds towards marketing efforts to reach new customers and expand the business’s reach.

- Develop new products or services: Set aside funds for research and development to introduce new offerings that can drive growth.

Role of Forecasting in Budgeting

Forecasting plays a critical role in budgeting for growth and expansion as it helps businesses anticipate future trends and plan accordingly. By analyzing market data, consumer behavior, and industry trends, small businesses can make informed decisions about where to allocate resources for growth.

Forecasting allows businesses to project future revenue and expenses, enabling them to create a budget that supports their growth objectives.