Get ready to dive into the world of bond investment tips where we uncover the secrets to boosting your portfolio like never before. This journey will take you through the ins and outs of bond investments with a fresh perspective that will leave you wanting more.

In the following paragraphs, we’ll explore the importance of including bonds in your investment mix, factors to consider before diving in, tips for selecting the right bonds, and strategies to manage risks effectively.

Importance of Bond Investments

Bonds play a crucial role in a diversified investment portfolio, offering stability and income potential. Let’s delve into why bond investments are essential:

Bonds Provide Income and Stability

- Bonds provide fixed interest payments to investors, offering a reliable income stream.

- They act as a hedge against stock market volatility, as they tend to be less risky than stocks.

- During economic downturns, bonds can offer stability and help preserve capital.

Types of Bonds

- Government Bonds: Issued by governments, considered low-risk due to backing by the government.

- Corporate Bonds: Issued by corporations, offering higher yields but with varying levels of risk.

- Municipal Bonds: Issued by state and local governments, often providing tax advantages for investors.

- Treasury Bonds: Issued by the U.S. Treasury, considered very low-risk and backed by the government.

Factors to Consider Before Investing in Bonds

When considering investing in bonds, it is essential to take into account various factors that can impact your investment decisions. Understanding the risk factors associated with bond investments, the influence of interest rates on bond prices, and the credit quality of bonds are crucial for making informed choices.

Risk Factors Associated with Bond Investments

- Bond Default Risk: This is the risk that the issuer of the bond may fail to make interest payments or repay the principal amount.

- Interest Rate Risk: Bonds are sensitive to changes in interest rates, with prices typically moving in the opposite direction of interest rates.

- Reinvestment Risk: When interest rates decline, investors may face the challenge of reinvesting their coupon payments at lower rates.

Impact of Interest Rates on Bond Prices

- As interest rates rise, bond prices tend to fall, and vice versa. This is because newly issued bonds offer higher yields, making existing bonds less attractive.

- Conversely, when interest rates fall, bond prices tend to rise as older bonds with higher coupon rates become more desirable.

- Understanding this relationship is crucial for investors looking to buy or sell bonds in different interest rate environments.

Credit Quality of Bonds and Its Significance for Investors

- Credit quality refers to the issuer’s ability to repay debt obligations. Bonds with higher credit ratings are considered less risky and typically offer lower yields.

- Investors should assess the credit quality of bonds before investing to determine the likelihood of default and the potential impact on their investment returns.

- Higher credit quality bonds may provide more stability and security, while lower credit quality bonds offer the potential for higher returns but come with increased risk.

Tips for Selecting Bonds

When it comes to selecting bonds for your investment portfolio, there are several key factors to consider in order to maximize your returns and manage risk effectively.

Choosing Between Corporate, Municipal, and Government Bonds

- Corporate Bonds: These are issued by corporations and typically offer higher yields than government bonds. However, they also come with higher risk. Consider the financial health of the company before investing.

- Municipal Bonds: Issued by local governments, these bonds offer tax advantages for investors. Look into the credit rating of the municipality to assess risk.

- Government Bonds: Considered the safest option, government bonds are backed by the full faith and credit of the government. They offer lower returns but are a good choice for conservative investors.

Importance of Diversification within a Bond Portfolio

Diversification is key to reducing risk in your bond portfolio. By investing in a mix of corporate, municipal, and government bonds, you can spread out risk and protect your investments from fluctuations in any one sector.

Determining the Maturity Period of Bonds Based on Investment Goals

- Short-Term Goals: If you have short-term financial goals, consider investing in bonds with a shorter maturity period. These bonds are less sensitive to interest rate changes and offer quicker returns.

- Long-Term Goals: For long-term goals like retirement planning, opt for bonds with longer maturity periods. While they may be more sensitive to interest rate changes, they typically offer higher yields over time.

Managing Risks in Bond Investments

When investing in bonds, it’s essential to consider the various risks involved to make informed decisions. Here we will discuss strategies to mitigate interest rate risk, the role of bond ratings in risk management, and how inflation can impact bond investments.

Interest Rate Risk Mitigation

Interest rate risk refers to the potential for bond prices to decrease when interest rates rise. To mitigate this risk, consider the following strategies:

- Diversify your bond portfolio by investing in bonds with different maturities.

- Consider investing in floating-rate bonds that adjust their interest payments based on prevailing market rates.

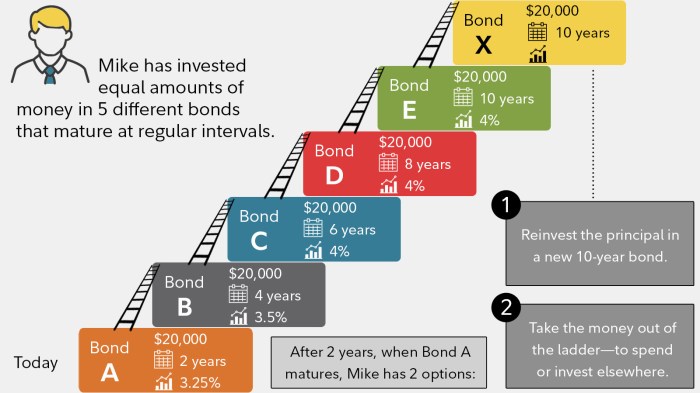

- Use bond laddering to spread out maturities and minimize the impact of interest rate fluctuations.

Bond Ratings in Risk Management

Bond ratings provide investors with an indication of the creditworthiness of bond issuers. Higher-rated bonds are considered less risky, while lower-rated bonds carry higher risk. When managing risks in bond investments:

- Focus on investing in bonds with higher credit ratings to reduce the risk of default.

- Monitor changes in bond ratings to stay informed about the financial health of bond issuers.

- Consider diversifying across different bond issuers and industries to spread out credit risk.

Inflation Impact and Protection

Inflation erodes the purchasing power of fixed-income investments like bonds. To protect against the impact of inflation on bond investments:

- Consider investing in Treasury Inflation-Protected Securities (TIPS) that offer protection against inflation by adjusting the principal value based on changes in the Consumer Price Index (CPI).

- Choose bonds with higher coupon rates to offset the effects of inflation on bond returns.

- Review the duration of your bond investments to ensure they align with your inflation protection goals.