Ready to dive into the world of financial statements? In this guide, we’ll break down the basics of reading and understanding financial statements, helping you decode the language of business numbers.

Introduction to Financial Statements

Financial statements are crucial documents that provide a snapshot of a company’s financial performance and position at a specific point in time. These statements are essential for both companies and stakeholders to assess the financial health and make informed decisions.

Main Types of Financial Statements

- The Income Statement: This statement shows a company’s revenues, expenses, and net income over a specific period, typically a fiscal quarter or year.

- The Balance Sheet: This statement presents a company’s assets, liabilities, and shareholders’ equity at a particular date, providing insights into its financial position.

- The Cash Flow Statement: This statement details the cash inflows and outflows from operating, investing, and financing activities, giving a clear picture of a company’s liquidity and cash flow management.

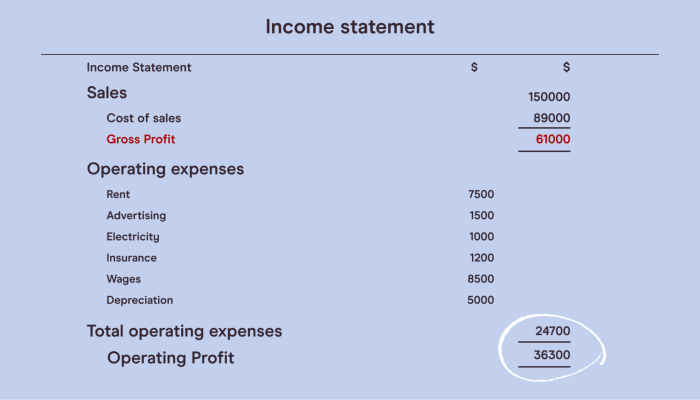

Understanding the Income Statement

When it comes to understanding the financial health of a company, the income statement plays a crucial role. It provides a snapshot of a company’s revenues, expenses, and overall profitability.

Components of an Income Statement

- Revenue: This is the total amount of money generated from sales of goods or services.

- Expenses: These are the costs incurred in the process of generating revenue, including operating expenses, interest, and taxes.

- Net Income: Also known as the bottom line, this is the amount left after deducting expenses from revenue, indicating the company’s overall profitability.

Interpreting the Income Statement for Profitability

One key way to assess a company’s profitability is by looking at its net income. A higher net income indicates that the company is generating more revenue than it is spending on expenses, leading to potential growth and investment opportunities.

Impact of Items on the Income Statement

For example, an increase in revenue can signify strong demand for a company’s products or services, while a decrease in expenses may indicate improved cost management. However, a significant rise in expenses without a corresponding increase in revenue could raise concerns about the company’s efficiency and profitability.

Analyzing the Balance Sheet

When analyzing a company’s financial health, the balance sheet is a crucial tool that provides a snapshot of its financial position at a specific point in time. It presents a summary of a company’s assets, liabilities, and equity, which are the building blocks of the company’s financial structure.

Key Elements of a Balance Sheet

The balance sheet consists of three main components:

- Assets: These are resources owned by the company that hold economic value, such as cash, inventory, property, and equipment.

- Liabilities: These represent the company’s obligations or debts, including loans, accounts payable, and accrued expenses.

- Equity: Equity reflects the company’s net worth, calculated as assets minus liabilities. It represents the residual interest in the company’s assets after deducting its liabilities.

Using the Balance Sheet for Evaluation

The balance sheet helps assess a company’s liquidity and solvency:

- Liquidity: By analyzing the composition of current assets and current liabilities, investors can determine the company’s ability to meet short-term obligations. A higher ratio of current assets to current liabilities indicates better liquidity.

- Solvency: Solvency measures a company’s ability to meet long-term financial obligations. Investors look at the debt-to-equity ratio to evaluate solvency, with lower ratios indicating a stronger financial position.

Deciphering the Cash Flow Statement

Understanding the cash flow statement is crucial for evaluating a company’s financial health and liquidity. It provides insights into how cash is generated and used by the business, offering a different perspective from the income statement and balance sheet.

Operating Activities

Operating activities involve the day-to-day business operations that impact cash flow. These include cash receipts from sales, payments to suppliers, salaries, and other operational expenses. Positive cash flow from operating activities indicates that the company is generating enough cash to support its core business.

Investing Activities

Investing activities involve the purchase and sale of long-term assets, such as property, equipment, or investments. Cash flow from investing activities reflects the company’s investments in its future growth or divestment of assets. Positive cash flow from investing activities may indicate strategic investments for future profitability.

Financing Activities

Financing activities include transactions related to raising capital and repaying debt. This section shows how the company is financing its operations and expansion. Cash flow from financing activities includes issuing or repurchasing stock, issuing or repaying debt, and paying dividends. Positive cash flow from financing activities might indicate the company’s ability to raise capital effectively.

Analyzing cash flow trends is essential for understanding a company’s financial health. Consistent positive cash flow from operating activities is a good sign, indicating that the company can meet its obligations and fund future growth. On the other hand, negative cash flow from operating activities may raise concerns about the company’s ability to generate sufficient cash.

In summary, the cash flow statement provides valuable information about how cash moves in and out of a company, offering insights into its liquidity, operational efficiency, and financial stability.