Credit score ranges explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding the basics of credit scores to exploring the impact on financial decisions, this topic dives deep into the world of credit.

As we delve into factors affecting credit scores, different credit score ranges, and strategies for improvement, get ready to unlock the secrets behind your credit score and how it shapes your financial future.

Understanding Credit Score Ranges

When it comes to understanding credit score ranges, it’s essential to grasp the concept of credit scores and how they impact financial decisions.

Credit Scores Defined

Credit scores are numerical representations of an individual’s creditworthiness, based on their credit history and financial behavior. They range from 300 to 850, with higher scores indicating a lower credit risk.

Importance of Credit Score Ranges

Credit score ranges play a crucial role in various financial decisions, such as loan approvals, interest rates, and even job opportunities. Lenders use credit scores to assess the risk of lending money to individuals, making it imperative to maintain a good score.

Factors Affecting Credit Scores

When it comes to credit scores, there are several key factors that can influence your overall score. These factors play a crucial role in determining your creditworthiness and financial stability. Let’s dive into some of the most important elements that affect credit scores.

Payment History

Your payment history is one of the most significant factors that impact your credit score. It accounts for about 35% of your overall score. Lenders want to see that you have a history of making on-time payments on your credit accounts. Late payments, defaults, and collections can have a negative impact on your score. On the flip side, consistently making timely payments can help boost your credit score over time.

Credit Utilization

Credit utilization refers to the ratio of your credit card balances to your credit limits. It is another critical factor that affects your credit score, representing about 30% of the total score. Keeping your credit utilization low, ideally below 30%, shows lenders that you are responsible with your credit and not overly reliant on borrowed funds. High credit utilization can signal financial distress and may result in a lower credit score. Monitoring and managing your credit card balances can help improve your credit utilization ratio and, in turn, your credit score.

Different Credit Score Ranges

When it comes to credit scores, there are different ranges that credit bureaus use to categorize individuals based on their creditworthiness.

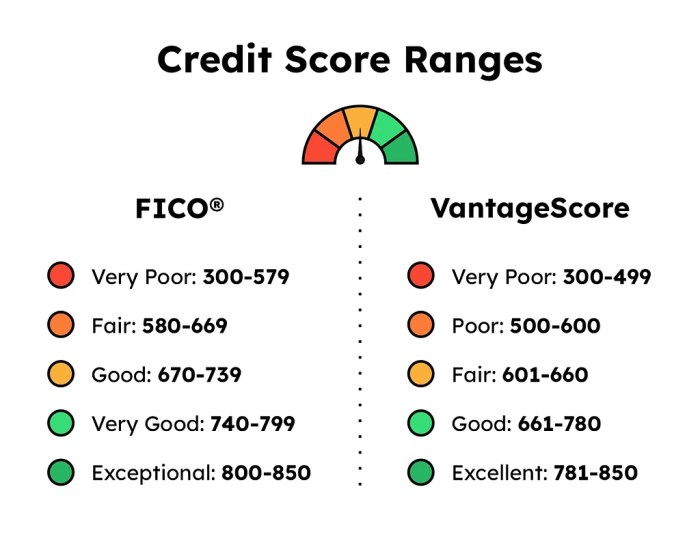

Common Credit Score Ranges

- FICO Score: The FICO credit score range is typically from 300 to 850. Categories include:

– Poor: 300 – 579

– Fair: 580 – 669

– Good: 670 – 739

– Very Good: 740 – 799

– Excellent: 800 – 850 - VantageScore: VantageScore ranges from 300 to 850 as well, but the categories are slightly different:

– Very Poor: 300 – 499

– Poor: 500 – 600

– Fair: 601 – 660

– Good: 661 – 780

– Excellent: 781 – 850

Comparison of Credit Score Range Models

- FICO vs. VantageScore:

– FICO is the most widely used credit scoring model, while VantageScore is gaining popularity.

– FICO puts more emphasis on payment history and credit utilization, while VantageScore considers trended data and has a shorter credit history requirement.

– Both models aim to predict a borrower’s likelihood of repaying debt, but they may produce slightly different scores for the same individual.

Impact of Credit Score Ranges

Having a good credit score can open up a world of borrowing opportunities for individuals. Lenders use credit scores to assess the risk of lending money, so understanding how credit score ranges affect borrowing is crucial.

Relationship Between Credit Score Ranges and Interest Rates

- Individuals with higher credit scores typically qualify for lower interest rates on loans and credit cards.

- Lower interest rates mean lower monthly payments and less money paid over the life of the loan, saving the borrower money in the long run.

- Conversely, individuals with lower credit scores may face higher interest rates, resulting in higher monthly payments and increased overall cost of borrowing.

Credit Score Ranges Influence Approval for Loans or Credit Cards

- Lenders are more likely to approve individuals with higher credit scores for loans and credit cards due to lower perceived risk.

- Higher credit scores signal to lenders that the individual is more likely to repay the borrowed money on time, making them a more attractive borrower.

- On the other hand, individuals with lower credit scores may struggle to get approved for loans or credit cards, or may face higher interest rates and stricter terms.

Improving Credit Score within Ranges

To improve credit scores within specific ranges, individuals can follow certain strategies and tips to maintain a good credit score range. It is important to understand the factors affecting credit scores and work towards improving them over time.

Strategies for Improving Credit Scores

- Pay bills on time: Timely payments are crucial for maintaining a good credit score. Set up automatic payments or reminders to avoid missing due dates.

- Reduce credit utilization: Keep credit card balances low and try to pay off debts to lower the credit utilization ratio.

- Monitor credit reports: Regularly check credit reports for errors or suspicious activities that may harm credit scores. Dispute inaccuracies to improve scores.

- Diversify credit mix: Having a mix of credit accounts such as credit cards, loans, and mortgages can positively impact credit scores.

- Avoid opening multiple new accounts: Opening several new accounts within a short period can lower credit scores. Be strategic when applying for new credit.

Tips for Maintaining a Good Credit Score Range

- Keep credit card balances low: Aim to use only a small percentage of available credit to show responsible credit management.

- Avoid closing old accounts: Length of credit history is a factor in credit scores. Keep old accounts open to demonstrate a long credit history.

- Limit credit inquiries: Multiple credit inquiries can signal financial distress. Be cautious when applying for new credit.

- Regularly review credit reports: Stay informed about credit activity and address any issues promptly to maintain a good credit score.

Timeline for Seeing Improvements in Credit Score Ranges

Improving credit scores takes time and consistent effort. Small changes may be reflected in credit scores within a few months, but significant improvements can take a year or more. Patience and discipline are key to achieving better credit scores.