Get ready to dive into the world of loan repayment schedules, where different types and factors play a crucial role in shaping your financial future. Let’s explore the ins and outs of this essential aspect of borrowing money.

From fixed to variable schedules, we’ll break down everything you need to know in a fun and informative way.

Loan Repayment Schedules

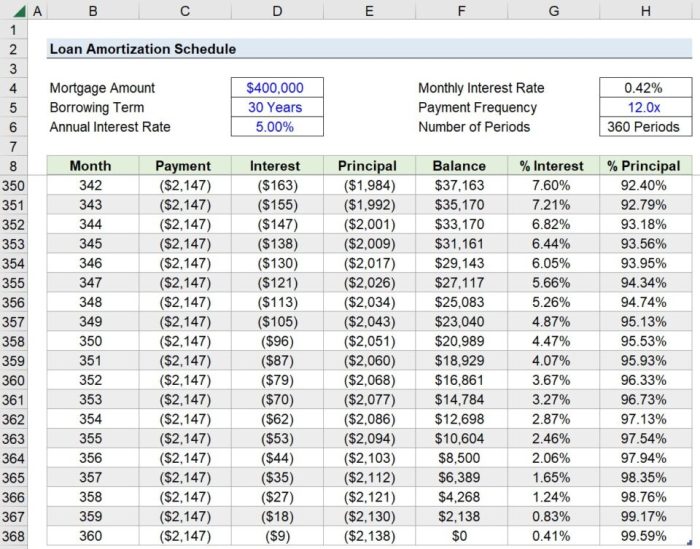

When you borrow money, whether it’s for a big purchase like a house or for your education, you will need to repay that loan over time. A loan repayment schedule Artikels the details of how you will pay back the borrowed amount, including the amount due each month, the interest rate, and the total length of time it will take to repay the loan.

Types of Loan Repayment Schedules

- Fixed: In a fixed repayment schedule, the borrower pays the same amount each month until the loan is fully repaid. This type of schedule provides predictability and stability in budgeting for the borrower.

- Variable: With a variable repayment schedule, the monthly payment amount can fluctuate based on changes in interest rates. This type of schedule can result in lower initial payments but carries the risk of increased payments in the future.

- Graduated: A graduated repayment schedule starts with lower monthly payments that increase over time. This type of schedule is often used for borrowers who expect their income to increase gradually.

Importance of Understanding Loan Repayment Schedules

Understanding your loan repayment schedule is crucial for borrowers to effectively manage their finances and avoid falling behind on payments. It allows borrowers to plan their budgets, anticipate changes in payment amounts, and make informed decisions about their financial future. By knowing the details of your repayment schedule, you can stay on track with your payments and avoid potential financial pitfalls.

Factors Influencing Loan Repayment Schedules

Factors influencing loan repayment schedules can vary based on several key components. One of the primary factors that significantly impacts the structure of repayment schedules is the interest rate associated with the loan. The interest rate determines the additional amount borrowers must pay back on top of the principal loan amount. This can greatly affect the total amount due and the length of time required for repayment.

Interest Rates Impact

Interest rates play a crucial role in shaping loan repayment schedules. Higher interest rates result in larger monthly payments and increased total interest paid over the life of the loan. On the other hand, lower interest rates lead to smaller monthly payments and reduced overall interest costs. Borrowers should carefully consider the impact of interest rates when deciding on a loan amount and term length.

Loan Amount and Term Length Influence

The loan amount and term length also play a significant role in determining repayment schedules. A larger loan amount typically requires higher monthly payments, while a smaller loan amount results in lower monthly payments. Additionally, the term length of the loan affects the repayment schedule, with longer terms leading to lower monthly payments but higher total interest costs. Borrowers should assess their financial situation and consider these factors when selecting a loan amount and term length for optimal repayment.

Types of Repayment Plans

When it comes to repaying your loans, there are a few different options to consider. Let’s take a look at the various types of repayment plans and their pros and cons.

Standard Repayment Plan

The standard repayment plan is the most common option where you make fixed monthly payments over a period of 10 years. This plan typically results in higher monthly payments but allows you to pay off your loan faster, saving you money on interest in the long run.

Income-Driven Repayment Plan

Income-driven repayment plans adjust your monthly payments based on your income, making it more manageable for those with lower salaries. While this can be beneficial for borrowers struggling to make ends meet, it may result in paying more interest over time due to longer repayment periods.

Extended Repayment Plan

Extended repayment plans extend your repayment period beyond the standard 10 years, resulting in lower monthly payments. This can be helpful for those looking to reduce their monthly financial burden, but it also means paying more interest over the life of the loan.

Overall, the best repayment plan for you will depend on your financial situation and goals. For example, a standard plan may be ideal if you want to pay off your loan quickly and save on interest, while an income-driven plan may be better if you have a lower income. Consider your options carefully and choose the plan that works best for you.

Creating a Loan Repayment Schedule

Creating a personalized loan repayment schedule is essential to manage your debt effectively. By following a few simple steps and utilizing available tools and resources, you can stay organized and on track with your repayment plan.

Steps to Create a Personalized Loan Repayment Schedule

- Evaluate your current financial situation: Start by gathering information about your loan amount, interest rate, and term.

- Calculate your monthly payments: Use online calculators or spreadsheet tools to determine how much you need to pay each month.

- Set a realistic timeline: Establish a repayment timeline based on your budget and financial goals.

- Adjust as needed: Be flexible and make adjustments to your repayment schedule if your financial situation changes.

Tools and Resources for Managing Loan Repayment Schedules

- Loan calculators: Online tools can help you estimate monthly payments and total interest over the life of the loan.

- Financial apps: Apps like Mint or You Need a Budget can help you track your expenses and stay on top of your repayment schedule.

- Automatic payments: Setting up automatic payments can ensure that you never miss a payment deadline.

Tips for Staying Organized and On Track

- Create a budget: Knowing where your money is going can help you allocate funds towards your loan payments.

- Track your progress: Regularly review your repayment schedule to see how far you’ve come and what adjustments may be needed.

- Reward yourself: Celebrate milestones along the way to stay motivated and focused on your repayment goals.