Step into the world of credit repair strategies where financial empowerment and knowledge collide. Get ready for a ride filled with tips, tricks, and insights to help you navigate the maze of credit scores and financial health.

In this guide, we’ll delve into the essentials of credit repair strategies, from understanding credit scores to implementing effective methods tailored to different financial situations.

Introduction to Credit Repair

Credit repair strategies refer to the actions taken by individuals to improve their credit scores and overall financial health.

Having a good credit score is essential for obtaining loans, credit cards, and favorable interest rates. It can also impact job opportunities, housing options, and insurance premiums.

Importance of Credit Repair

- Repairing credit can help individuals qualify for better financial products and services.

- Improving credit scores can lead to lower interest rates and better loan terms.

- Good credit can provide financial security and peace of mind for the future.

Common Reasons for Seeking Credit Repair

- Previous financial mistakes, such as missed payments or defaults, can negatively impact credit scores.

- Identity theft and fraud can result in unauthorized accounts and damage to credit histories.

- Unexpected life events, like medical emergencies or job loss, may lead to financial difficulties and the need for credit repair.

Understanding Credit Scores

Credit scores play a crucial role in determining an individual’s financial health and opportunities. It is essential to understand how credit scores are calculated, factors that influence them, and their impact on financial opportunities.

Calculation of Credit Scores

Credit scores are calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. The most commonly used credit score model is FICO, which ranges from 300 to 850. A higher credit score indicates better creditworthiness, while a lower score may signal potential credit risks.

Factors Influencing Credit Scores

Several factors can influence credit scores, such as late payments, high credit utilization, age of credit accounts, credit mix, and new credit inquiries. It is essential to maintain a good payment history, keep credit card balances low, and avoid opening multiple new credit accounts within a short period.

Impact of Credit Scores on Financial Opportunities

Credit scores can significantly impact an individual’s financial opportunities. A higher credit score can make it easier to qualify for loans, credit cards, and favorable interest rates. On the other hand, a lower credit score may lead to higher interest rates, difficulty in obtaining credit, or even denial of credit applications.

Types of Credit Repair Strategies

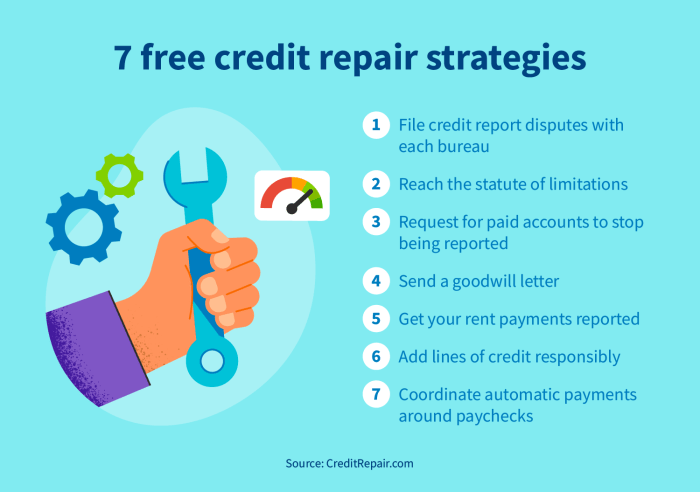

When it comes to improving credit scores, there are various methods that individuals can utilize. Understanding the difference between do-it-yourself (DIY) credit repair and professional services is crucial in determining the best approach for your financial situation.

DIY Credit Repair Strategies

- Reviewing credit reports for errors and inaccuracies

- Disputing negative items with credit bureaus

- Paying down outstanding debts

- Setting up automatic payments to ensure timely payments

Professional Credit Repair Services

- Working with credit repair companies to handle disputes and negotiations

- Creating personalized credit repair plans based on individual financial situations

- Providing ongoing support and guidance throughout the credit repair process

Credit Repair Strategies for Different Financial Situations

- For individuals with high debt levels: focusing on debt repayment and debt consolidation

- For individuals with a limited credit history: opening a secured credit card or becoming an authorized user on someone else’s account

- For individuals with a history of missed payments: setting up payment reminders or automatic payments to avoid future delinquencies

Tips for Implementing Credit Repair Strategies

When it comes to repairing your credit, it’s essential to have a clear plan of action and stick to good financial habits. Here are some tips to help you get started on the right track:

Step-by-Step Guidance

- Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, TransUnion) to identify any errors or negative items.

- Contact the credit bureaus to dispute any inaccuracies on your credit report and request corrections.

- Develop a budget to ensure you can make timely payments on your existing debts and avoid accumulating more debt.

- Prioritize paying off high-interest debts first to reduce the overall amount you owe and improve your credit utilization ratio.

Best Practices for Maintaining Good Credit Habits

- Pay your bills on time every month to establish a positive payment history.

- Keep your credit card balances low and avoid maxing out your credit limits.

- Avoid opening multiple new credit accounts within a short period, as this can negatively impact your credit score.

- Regularly monitor your credit report to track your progress and catch any potential issues early on.

Potential Challenges During the Credit Repair Process

- Dealing with creditors or collection agencies who may not be willing to negotiate payment terms or remove negative items from your credit report.

- Falling back into old spending habits and accumulating more debt while trying to pay off existing balances.

- Feeling overwhelmed or discouraged by the slow progress of credit repair and the time it takes to see improvements in your credit score.

Monitoring Progress and Adjusting Strategies

Monitoring your progress and adjusting your credit repair strategies are essential steps in improving your credit score. By keeping track of changes in your credit score, you can make informed decisions on when and how to adjust your strategies to achieve better results. Staying motivated throughout this journey is crucial for long-term success.

Tracking Changes in Credit Scores

- Regularly check your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion.

- Look for any errors or discrepancies in your report that could be negatively impacting your score.

- Monitor changes in your credit score over time to see the impact of your credit repair efforts.

Adjusting Credit Repair Strategies

- If you notice positive changes in your credit score, continue with your current strategies and consider adding new tactics for further improvement.

- If your credit score remains stagnant or decreases, reevaluate your strategies and identify areas where adjustments can be made.

- Consult with a credit counselor or financial advisor for personalized advice on adjusting your credit repair strategies.

Staying Motivated

- Set realistic goals and celebrate small victories along the way to keep yourself motivated.

- Track your progress visually by creating a chart or graph to see how far you’ve come in repairing your credit.

- Stay connected with a support system of friends or family members who can encourage you during challenging times.