Yo, check it – we’re diving into the world of loan interest rate calculation. Get ready for a wild ride filled with different methods, key factors, and all the juicy details you need to know.

Let’s break it down in a way that’s easy to understand and straight to the point.

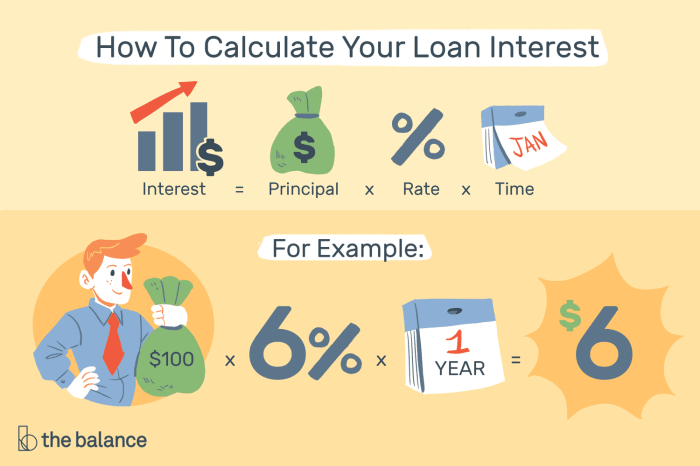

Loan Interest Rate Calculation Methods

When it comes to calculating loan interest rates, there are different methods that are commonly used. Two of the most common methods are compound interest and simple interest. Let’s dive into how these methods are applied in loan calculations and the impact of compounding frequency on the total interest paid on a loan.

Compound Interest vs. Simple Interest

Compound interest is when interest is calculated on both the initial principal and the accumulated interest from previous periods. This means that the interest amount grows over time, resulting in a higher total interest paid on the loan. On the other hand, simple interest is calculated only on the initial principal amount, without taking into account any previously accrued interest.

Examples of Compound Interest and Simple Interest

- For example, if you borrow $1,000 at a 5% annual interest rate for 3 years:

- Using compound interest: Interest is calculated on the initial $1,000 and the accrued interest from previous years, resulting in a higher total interest paid.

- Using simple interest: Interest is calculated only on the initial $1,000, without considering any previously accrued interest.

Impact of Compounding Frequency

The frequency at which interest is compounded can significantly impact the total interest paid on a loan. The more frequently interest is compounded, the higher the effective interest rate and the more interest you will end up paying over the life of the loan. For example, a loan with monthly compounding will accumulate more interest compared to a loan with annual compounding.

Factors Affecting Loan Interest Rates

When it comes to loan interest rates, several key factors come into play that can influence the rate offered by lenders. These factors include the borrower’s credit score, market conditions, economic indicators, and more. Understanding these factors can help borrowers make informed decisions when seeking a loan.

Borrower’s Credit Score

The borrower’s credit score plays a significant role in determining the interest rate offered by lenders. A higher credit score typically indicates to lenders that the borrower is more likely to repay the loan on time. As a result, borrowers with higher credit scores are often offered lower interest rates compared to those with lower credit scores. Lenders see borrowers with lower credit scores as higher risk, leading to higher interest rates to mitigate that risk.

Market Conditions and Economic Indicators

Market conditions and economic indicators also play a crucial role in determining loan interest rates. Lenders take into account factors such as inflation, unemployment rates, GDP growth, and the overall state of the economy when setting interest rates. For example, during times of economic growth, interest rates may rise to combat inflation. Conversely, during economic downturns, interest rates may be lowered to stimulate borrowing and spending.

Understanding APR vs. Interest Rate

When it comes to borrowing money, it’s crucial to understand the difference between Annual Percentage Rate (APR) and interest rate. While both are important factors in loan calculations, they serve different purposes and can impact the overall cost of borrowing significantly.

APR includes not only the interest rate charged on the loan amount but also any additional fees or charges imposed by the lender. This means that APR provides a more comprehensive picture of the total cost of borrowing compared to the interest rate alone. For example, if you are comparing two loan offers with the same interest rate but different APRs, the one with the higher APR likely includes more fees and charges, making it a more expensive option in the long run.

Understanding the difference between APR and interest rate is crucial for borrowers because it allows them to make informed decisions about their borrowing options. By considering both the interest rate and APR, borrowers can accurately assess the true cost of a loan and choose the option that best fits their financial situation. This knowledge empowers borrowers to avoid hidden costs and make smart financial choices when taking out loans.

Illustrative Examples

- Loan A has an interest rate of 5% and an APR of 5.5% due to additional fees.

- Loan B has an interest rate of 6% and an APR of 6.5% because of higher closing costs.

- Comparing the two loans, Loan B is more expensive overall despite having a lower interest rate.

Calculating Loan Payments

When it comes to calculating loan payments, it’s essential to understand the formula that determines the monthly amount you’ll need to pay. By considering the loan amount, interest rate, and term, you can easily calculate how much you’ll be paying each month. Let’s break it down step by step.

Formula for Calculating Monthly Loan Payments

To calculate your monthly loan payment, you can use the following formula:

Monthly Payment = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

– P = Loan amount

– r = Monthly interest rate (annual interest rate divided by 12)

– n = Number of months in the loan term

Now, let’s go through a step-by-step guide on how to calculate loan payments using this formula.

Step-by-Step Guide

- First, determine the loan amount (P), the interest rate, and the term of the loan in months (n).

- Next, calculate the monthly interest rate (r) by dividing the annual interest rate by 12.

- Plug the values of P, r, and n into the formula: Monthly Payment = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

- Compute the monthly payment using the formula to find out how much you need to pay each month.

Understanding the loan term is crucial in determining the monthly payment amount.

Significance of Loan Term

The loan term plays a significant role in determining the monthly payment amount. A longer loan term typically results in lower monthly payments, but you’ll end up paying more in interest over the life of the loan. On the other hand, a shorter loan term means higher monthly payments but less interest paid overall. It’s essential to consider your financial situation and goals when deciding on the loan term that works best for you.