Diving deep into the world of dividend payout ratios, this introduction sets the stage for a thrilling exploration that will leave you craving for more. Get ready to uncover the secrets behind these financial metrics in a way that’s as cool as hanging out at the local skate park.

Now, let’s break it down and see what makes dividend payout ratios tick.

Introduction to Dividend Payout Ratios

Dividend payout ratios are a financial metric used by investors to evaluate how much of a company’s earnings are being distributed to shareholders in the form of dividends. It is calculated by dividing the total dividends paid out by the company by its net income.

Investors pay close attention to dividend payout ratios as they provide insight into a company’s financial health and management’s decision-making process. A high dividend payout ratio could indicate that a company is returning a significant portion of its profits to shareholders, while a low ratio may suggest that the company is reinvesting more earnings back into the business for growth.

Calculating Dividend Payout Ratios

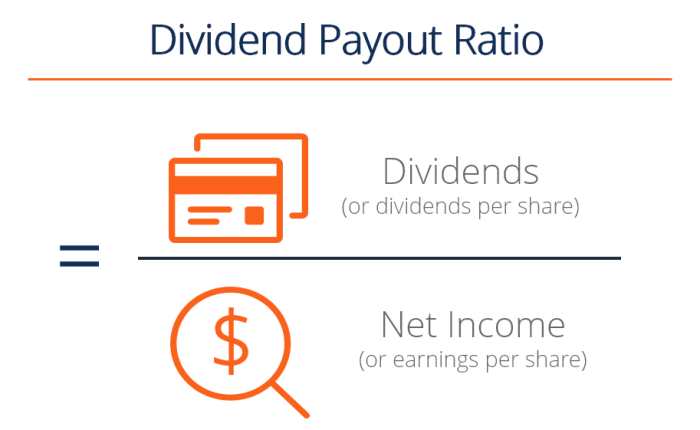

To calculate the dividend payout ratio, you can use the following formula:

Dividend Payout Ratio = Total Dividends Paid / Net Income

For example, if a company paid out $1,000,000 in dividends and had a net income of $2,000,000, the dividend payout ratio would be 0.5 or 50%.

Types of Dividend Payout Ratios

When it comes to analyzing dividend payouts, there are three main types of ratios that investors typically look at: dividend payout ratio, dividend yield, and dividend coverage ratio.

Dividend Payout Ratio

The dividend payout ratio is a metric used to determine the percentage of earnings a company pays out to its shareholders in the form of dividends. It is calculated by dividing the total dividends paid by the company by its net income. A high dividend payout ratio indicates that a company is distributing a large portion of its earnings to shareholders, while a low ratio suggests that the company is retaining more earnings for reinvestment.

Dividend Yield

Dividend yield is a measure of how much a company pays out in dividends relative to its stock price. It is calculated by dividing the annual dividend per share by the price per share. A high dividend yield may indicate that a company is undervalued, while a low yield could suggest that the stock is overvalued.

Dividend Coverage Ratio

The dividend coverage ratio measures a company’s ability to sustain its current dividend payments. It is calculated by dividing the company’s earnings per share by the dividend per share. A ratio greater than 1 indicates that the company has enough earnings to cover its dividend payments, while a ratio less than 1 may raise concerns about the sustainability of the dividend.

Companies with high dividend payout ratios include real estate investment trusts (REITs) or utility companies, which typically pay out a large portion of their earnings to shareholders. On the other hand, technology companies or growth stocks may have low dividend payout ratios as they reinvest their earnings back into the business for growth and expansion.

Factors Affecting Dividend Payout Ratios

When it comes to dividend payout ratios, there are several key factors that can influence how much a company pays out to its shareholders. Let’s dive into some of the main considerations that impact dividend payout ratios.

Industry Type and Growth Stage

In the world of finance, industry type and growth stage play a significant role in determining a company’s dividend payout ratio. For example, mature companies in stable industries tend to have higher payout ratios since they generate consistent cash flows and have less need to reinvest in growth. On the other hand, young companies in fast-growing industries often have lower payout ratios as they prioritize reinvesting profits back into the business to fuel expansion.

Company’s Profitability and Cash Flow

A company’s profitability and cash flow are crucial determinants of its dividend payout ratio. Companies with strong profitability and healthy cash flows are more likely to have higher payout ratios, as they have the financial stability to sustain regular dividend payments. Conversely, companies facing financial challenges or experiencing cash flow constraints may opt for lower payout ratios to preserve capital for operational needs or future investments.

Importance of Dividend Payout Ratios for Investors

Dividend payout ratios are crucial for investors as they provide valuable insights into a company’s financial health. By analyzing these ratios, investors can make informed decisions about the stability and sustainability of a company’s dividend payments.

Assessing Financial Health

Dividend payout ratios help investors assess a company’s financial health by indicating how much of its earnings are being distributed as dividends. A high payout ratio may suggest that a company is returning a significant portion of its profits to shareholders, potentially leaving less room for reinvestment in the business. On the other hand, a low payout ratio could signal that a company is retaining more earnings for future growth opportunities.

Relationship with Stock Price Performance

The relationship between dividend payout ratios and stock price performance is intricate. Generally, companies with consistent and growing dividends tend to attract more investors, leading to an increase in demand for their stock. This increased demand can drive up the stock price, benefiting shareholders. Conversely, a company that cuts or eliminates its dividends may experience a decline in stock price as investors lose confidence in its financial stability.

Indicating Future Growth Prospects

Dividend payout ratios can also serve as indicators of a company’s future growth prospects. A stable or increasing payout ratio over time may suggest that a company is confident in its ability to generate consistent earnings. This confidence can translate into potential future growth opportunities, as investors may view such companies as financially sound and well-positioned for expansion.