Dive into the world of 401(k) investment options, where the choices you make today can shape your financial future tomorrow. From stocks to bonds, this guide will walk you through the essentials of maximizing your retirement savings.

Overview of 401(k) Investment Options

401(k) investment options are crucial components of retirement planning, allowing individuals to set aside funds for their golden years. These options provide a range of choices for allocating funds within a 401(k) plan, tailored to different risk appetites and investment goals.

Types of 401(k) Investment Options

- Stocks: Investing in company stocks offers the potential for high returns but comes with higher risks.

- Bonds: Bonds are considered safer investments, providing steady income but with lower returns.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

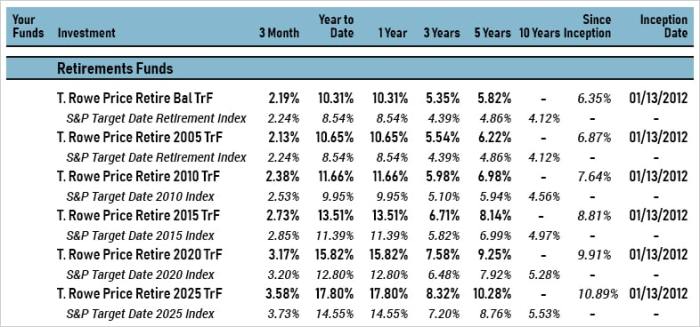

- Target-Date Funds: These funds automatically adjust the asset allocation based on the investor’s retirement date, becoming more conservative as retirement approaches.

Benefits of Diversifying 401(k) Investments

Diversifying 401(k) investments across different options is essential to mitigate risk and optimize returns. By spreading investments across various asset classes, individuals can reduce the impact of volatility in any single investment and increase the likelihood of long-term growth. Additionally, diversification helps align investments with the individual’s risk tolerance and financial goals, creating a well-balanced portfolio for retirement planning.

Common Types of 401(k) Investment Options

401(k) plans typically offer a variety of investment options to help employees grow their retirement savings. These options can include stocks, bonds, and mutual funds, each with its own risk and return profile.

Stocks

Stocks represent ownership in a company and have the potential for high returns but also come with high risk. They are known for their volatility and can experience significant price fluctuations in the short term.

Bonds

Bonds are debt securities issued by governments or corporations. They are considered safer than stocks because they provide a fixed income stream, but they generally offer lower returns. Bonds can help stabilize a portfolio during market downturns.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets. They offer a convenient way to access a variety of securities and are managed by professional fund managers. Mutual funds can range from conservative to aggressive, depending on the underlying assets.

By combining different types of investment options in a 401(k) plan, individuals can create a well-rounded portfolio that balances risk and return. For example, a portfolio may include a mix of stocks for growth potential, bonds for stability, and mutual funds for diversification. Diversifying across asset classes can help reduce overall risk and increase the likelihood of achieving long-term financial goals.

Factors to Consider When Choosing 401(k) Investment Options

When deciding on the investment options within your 401(k) plan, it is crucial to take into account various key factors that can impact your financial future.

Assessing your risk tolerance, investment goals, and time horizon are essential components to consider when making investment choices. Your risk tolerance refers to how comfortable you are with the possibility of your investments experiencing fluctuations in value. Understanding this can help you determine the level of risk you are willing to take with your investments.

Your investment goals play a significant role in deciding which investment options are most suitable for you. Whether you are saving for retirement, a major purchase, or your child’s education, your goals will shape the investment strategy you should adopt.

Another critical factor to consider is your time horizon, which refers to the length of time you have until you will need to access the funds in your 401(k). The longer your time horizon, the more risk you may be able to take on, as you have more time to potentially recover from any downturns in the market.

To align your investment options with your personal financial objectives, it is essential to have a clear understanding of your risk tolerance, investment goals, and time horizon. By carefully evaluating these factors, you can make informed decisions that will help you achieve your financial goals in the long run.

Strategies for Maximizing 401(k) Investment Options

Investing in a 401(k) is a smart way to plan for retirement, but knowing how to make the most of your investment options can help ensure long-term growth and financial stability. Here are some strategies to consider:

Asset Allocation for Enhanced Returns

Asset allocation is the strategic distribution of your investments across different asset classes such as stocks, bonds, and cash equivalents. By diversifying your portfolio, you can minimize risk and maximize returns within your 401(k) plan.

- Allocate your investments based on your risk tolerance and investment goals.

- Regularly review and adjust your asset allocation to stay aligned with your long-term financial objectives.

- Consider your investment horizon and adjust your asset mix accordingly to optimize growth potential.

Regular Review and Rebalancing Benefits

Regularly reviewing and rebalancing your 401(k) investment options is essential to ensure that your portfolio remains in line with your financial goals and risk tolerance. Here are some benefits:

- Helps to maintain a diversified portfolio and minimize concentration risk.

- Allows you to capitalize on market opportunities and adjust your investments accordingly.

- Ensures that your asset allocation is in line with your changing financial circumstances and retirement timeline.