As investing in index funds takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Index funds are like the cool kids of the investing world, offering a simple yet effective way to grow your money. Let’s dive in and uncover the secrets behind these financial gems.

What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds aim to replicate the performance of the index they are tracking by holding the same stocks in the same proportions as the index.

Examples of popular index funds

- Vanguard Total Stock Market Index Fund (VTSAX): This fund tracks the performance of the CRSP US Total Market Index, which includes large-, mid-, small-, and micro-cap stocks.

- S&P 500 Index Fund: This fund mirrors the performance of the S&P 500 index, which comprises 500 of the largest publicly traded companies in the U.S.

- NASDAQ-100 Index Fund: This fund follows the performance of the NASDAQ-100 index, which includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

Benefits of investing in index funds

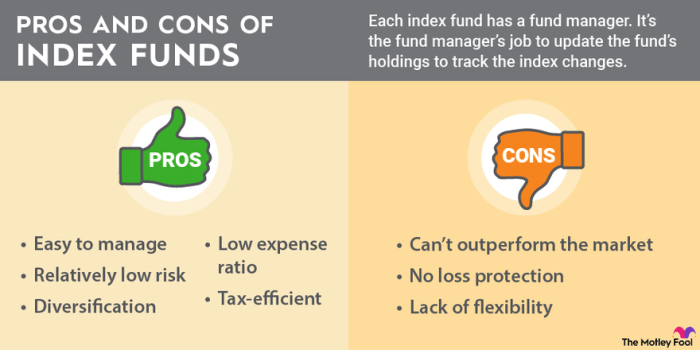

- Diversification: Index funds provide instant diversification by holding a basket of stocks, reducing individual stock risk.

- Low costs: Index funds typically have lower expense ratios compared to actively managed funds, resulting in lower fees for investors.

- Passive investing: Index funds require minimal maintenance as they aim to match the performance of the index, making them a hands-off investment option.

- Historical performance: Over the long term, index funds have shown to outperform many actively managed funds due to their lower costs and ability to capture market returns.

How do index funds work?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds are passively managed, meaning they do not involve active stock picking by a fund manager, but instead aim to replicate the returns of the underlying index.

Tracking a specific market index

Index funds work by holding a diversified portfolio of securities that closely mimics the components of the chosen index. For example, if an index fund is designed to track the S&P 500, it will hold the 500 stocks included in that index in the same proportion as they are weighted in the index. This allows investors to gain exposure to a broad market segment without having to purchase individual stocks.

Creating and managing an index fund

The process of creating an index fund involves selecting the appropriate index to replicate, determining the weighting of securities in the fund to match the index, and setting up the fund structure. Once the fund is established, it requires periodic rebalancing to ensure that it continues to track the index accurately. Index funds typically have lower operating expenses compared to actively managed funds, as there is less need for research and decision-making by fund managers.

Comparing performance with actively managed funds

Index funds are often compared with actively managed funds, which involve professional money managers selecting individual stocks in an attempt to outperform the market. Research has shown that over the long term, index funds tend to outperform actively managed funds due to their lower costs and consistent performance tracking the market index. While some active funds may outperform the market in the short term, the majority struggle to beat their benchmark index consistently over time.

Why consider investing in index funds?

Investing in index funds can be a smart choice for a variety of reasons. Let’s explore why they are a popular option for many investors, the potential risks involved, and strategies for maximizing returns.

Benefits of investing in index funds

- Low fees: Index funds typically have lower management fees compared to actively managed funds, allowing investors to keep more of their returns.

- Diversification: By investing in an index fund, you are essentially investing in a wide range of companies, spreading out your risk.

- Consistent returns: Index funds aim to replicate the performance of a specific market index, providing investors with consistent returns over the long term.

- Passive investing: Index funds require less active management, making them a hands-off approach to investing for those who prefer a more passive strategy.

Risks of investing in index funds

- Market risk: Since index funds track the performance of a specific market index, they are still subject to market fluctuations and volatility.

- Tracking error: The fund may not perfectly mirror the performance of the index due to tracking errors, leading to potential underperformance.

- Less flexibility: Index funds may limit your ability to make changes to the portfolio, as they are designed to replicate the index they track.

Strategies for maximizing returns

- Regular contributions: Consider making regular contributions to your index fund to take advantage of dollar-cost averaging and benefit from market fluctuations.

- Reinvestment of dividends: Reinvesting dividends earned from the index fund can help accelerate the growth of your investment over time.

- Periodic rebalancing: Review your portfolio periodically and rebalance if necessary to maintain the desired asset allocation and risk level.

How to choose the right index funds?

When selecting index funds, it’s essential to consider your investment goals, risk tolerance, and time horizon. Choosing the right index funds can help you achieve a diversified portfolio and potentially maximize returns over the long term.

Criteria for selecting suitable index funds

- Consider your investment goals: Determine whether you are investing for long-term growth, income, or a combination of both.

- Evaluate risk tolerance: Understand how much risk you are willing to take on and choose index funds that align with your risk profile.

- Assess time horizon: Decide how long you plan to invest in the index funds and choose funds that match your investment timeline.

Comparison of different types of index funds

- Stock market index funds: These funds track a specific stock market index, such as the S&P 500, providing broad exposure to a diverse range of companies.

- Bond market index funds: These funds track bond indexes, offering exposure to fixed-income securities and providing income through interest payments.

- Sector-specific index funds: These funds focus on specific sectors, such as technology, healthcare, or energy, allowing investors to target their investments in a particular industry.

Importance of expense ratios and diversification

- Expense ratios: Lower expense ratios can lead to higher returns for investors, so it’s crucial to choose index funds with competitive expense ratios to minimize costs.

- Diversification: Investing in a variety of index funds can help spread risk across different asset classes and sectors, reducing the impact of volatility on your portfolio.