Financial portfolio balancing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we dive into the world of balancing financial portfolios, we uncover the key strategies, importance of asset allocation, and the impact of rebalancing frequency on investor success. Get ready to explore the dynamic realm of financial portfolio balancing!

Importance of Financial Portfolio Balancing

When we talk about financial portfolio balancing, we’re basically referring to the act of adjusting the mix of assets in your investment portfolio to maintain a desired level of risk versus reward. It’s like keeping your financial house in order and making sure you’re not putting all your eggs in one basket.

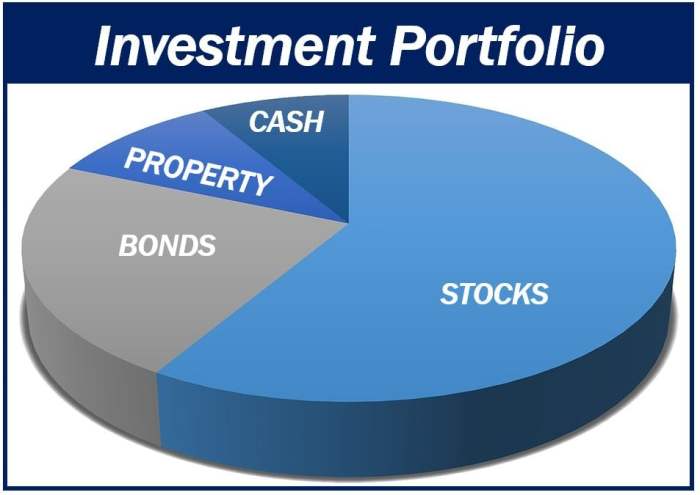

It’s crucial for investors to regularly balance their portfolios because it helps manage risk and optimize returns. By diversifying your investments across different asset classes like stocks, bonds, and real estate, you can reduce the impact of market volatility on your overall portfolio. This way, if one sector takes a hit, you won’t lose everything.

An unbalanced portfolio can pose risks to investors in various ways. For example, if you have too much of your money tied up in one particular stock and that company goes bankrupt, you could lose a significant portion of your investment. On the other hand, if you’re too heavily invested in low-risk assets like bonds, you might miss out on potential higher returns from riskier but more lucrative investments like stocks.

Risks of an Unbalanced Portfolio

- Increased vulnerability to market fluctuations

- Lack of diversification leading to higher potential losses

- Missed opportunities for higher returns

Strategies for Portfolio Balancing

Investors have a variety of strategies at their disposal to effectively balance their financial portfolios. One key aspect of portfolio balancing is the comparison between active and passive approaches, each with its own set of advantages and disadvantages. Additionally, the role of diversification plays a crucial part in minimizing risk and maximizing returns in a financial portfolio.

Active vs. Passive Portfolio Balancing

- Active portfolio balancing involves frequent buying and selling of assets in an attempt to outperform the market. This strategy requires in-depth research, market analysis, and a hands-on approach.

- Passive portfolio balancing, on the other hand, involves maintaining a fixed allocation of assets without frequent trading. This strategy often involves investing in index funds or ETFs to mirror the performance of a particular market index.

- Active balancing may incur higher fees due to the frequent trading, while passive balancing typically has lower costs associated with it.

The Role of Diversification

Diversification is a crucial strategy for balancing a financial portfolio as it involves spreading investments across different asset classes to reduce risk. By diversifying, investors can minimize the impact of poor performance in one asset class by having exposure to others that may perform well. This strategy helps in achieving a balance between risk and return in a portfolio.

Asset Allocation in Portfolio Balancing

When it comes to portfolio balancing, asset allocation plays a crucial role in determining the mix of investments within a portfolio. It involves dividing investments among different asset classes like stocks, bonds, and cash equivalents to achieve a balance between risk and return.

Importance of Asset Allocation

Asset allocation is important in portfolio balancing as it helps in diversifying investments and reducing overall risk. By spreading investments across various asset classes, investors can minimize the impact of market fluctuations on their portfolio. For example, if one asset class underperforms, other asset classes may help offset the losses, leading to more stable returns over time.

- Asset allocation can help mitigate risks in a portfolio by spreading investments across different asset classes with varying levels of risk and return potential.

- It allows investors to align their investment strategy with their risk tolerance and investment goals, ensuring a more balanced and diversified portfolio.

- By regularly rebalancing the portfolio based on changing market conditions and investment objectives, asset allocation helps investors stay on track towards achieving their long-term financial goals.

Impact of Asset Allocation on Long-Term Investment Goals

Asset allocation plays a significant role in determining the overall performance of a portfolio over the long term. By strategically allocating investments based on risk tolerance, time horizon, and financial goals, investors can achieve a more stable and consistent return on their investments.

Asset allocation is not about timing the market but time in the market. By maintaining a well-diversified portfolio across different asset classes, investors can reduce the impact of short-term market fluctuations and focus on their long-term investment objectives.

Rebalancing Frequency and Methods

When it comes to managing your financial portfolio, the frequency at which you rebalance it plays a crucial role in maintaining its desired risk and return profile. Rebalancing involves adjusting the allocation of assets in your portfolio to bring it back to your target mix. Let’s delve into the significance of determining the frequency of portfolio rebalancing and explore various methods investors can use to achieve this.

Determining Rebalancing Frequency

Determining how often you should rebalance your portfolio depends on your investment goals, risk tolerance, and market conditions. Some investors prefer to rebalance on a quarterly or annual basis, while others may opt for a more dynamic approach, rebalancing whenever asset allocations deviate significantly from their targets.

- Calendar-based rebalancing: This method involves setting specific dates throughout the year to review and rebalance your portfolio. It provides a disciplined approach and ensures that you regularly assess your investments.

- Threshold-based rebalancing: With this method, you establish tolerance bands around your target asset allocations. When the actual allocations exceed these thresholds, you rebalance your portfolio to realign with your targets.

Methods for Portfolio Rebalancing

There are several methods investors can use to rebalance their portfolios, each with its own advantages and considerations.

One common method is selling overweighted assets and buying underweighted assets to bring the portfolio back to its target allocation.

- Percentage-of-portfolio method: This approach involves rebalancing based on the percentage of the portfolio each asset class represents. For example, if stocks exceed their target allocation by 5%, you would sell a portion to realign with the target.

- Constant-weighting method: In this method, you maintain a fixed weight for each asset class in your portfolio. Rebalancing is done to ensure that the weights remain constant over time.

Scenarios Triggering Portfolio Rebalancing

Portfolio rebalancing may be prompted by various scenarios, including market fluctuations, changes in financial goals, and shifts in economic conditions.

- Market volatility: Significant market movements may cause your asset allocations to drift from their targets, necessitating rebalancing to manage risk.

- Life events: Changes in your financial situation, such as a new job, marriage, or retirement, may require adjustments to your investment strategy and asset allocations.