Ready to take control of your finances and say goodbye to debt? In this guide on how to reduce debt, we’ll break down the steps needed to achieve financial freedom and peace of mind. From understanding different types of debt to creating a solid repayment plan, we’ve got you covered. So, buckle up and get ready to embark on a journey towards a debt-free life!

Exploring the ins and outs of debt reduction strategies, this guide will equip you with the tools and knowledge to tackle your financial challenges head-on.

Understanding Debt

Debt is money borrowed by an individual or entity with the agreement to pay it back with interest over a specific period. There are various types of debt, including credit card debt, student loans, mortgages, and personal loans.

Carrying high levels of debt can have serious consequences, such as damaging your credit score, leading to financial stress, and limiting your ability to reach important financial goals. It can also result in paying more in interest over time, reducing your overall wealth.

Good Debt vs. Bad Debt

- Good debt is typically considered an investment in your future, such as student loans for education or a mortgage for a home. These types of debt can potentially increase your net worth over time.

- Bad debt, on the other hand, is usually used for purchases that do not increase in value or generate income, like credit card debt for unnecessary expenses. This type of debt can lead to financial trouble and should be avoided whenever possible.

Evaluating Current Debt

When it comes to evaluating your current debt situation, it’s important to have a clear understanding of where you stand financially. This involves calculating your total debt, reviewing interest rates and payment terms on existing debts, and accessing credit reports to get a comprehensive view of your debt status.

Calculating Total Debt

To calculate your total debt, start by making a list of all your outstanding debts, including credit card balances, student loans, car loans, and any other loans or debts you may have. Add up the total amount owed for each debt to get your overall debt balance.

Reviewing Interest Rates and Payment Terms

Once you have a list of your debts, it’s essential to review the interest rates and payment terms associated with each debt. Pay close attention to the interest rates, as higher rates can lead to more interest charges over time. Additionally, understanding the payment terms, such as minimum monthly payments and due dates, can help you manage your debts more effectively.

Accessing Credit Reports

Accessing your credit reports from the major credit bureaus (Equifax, Experian, TransUnion) can provide valuable insights into your debt status. Your credit report will show all the debts you owe, along with details such as payment history, credit limits, and account balances. By reviewing your credit reports regularly, you can stay informed about your debt situation and identify any potential errors or discrepancies that need to be addressed.

Creating a Budget

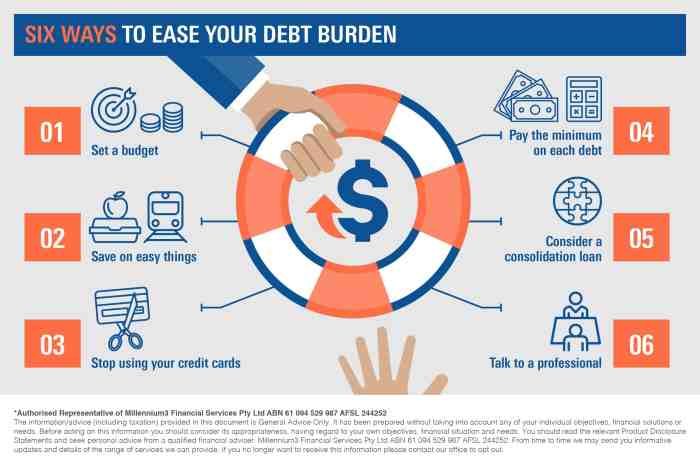

Creating a budget is crucial when managing debt as it helps you track your expenses, identify areas where you can cut back, and allocate funds towards debt repayment.

Tracking Expenses

- Start by recording all your expenses, including bills, groceries, entertainment, etc.

- Use apps or spreadsheets to categorize your expenses and see where your money is going.

- Review your spending regularly to identify areas where you can reduce costs.

Identifying Areas to Cut Back

- Avoid unnecessary expenses like eating out frequently or buying items you don’t need.

- Look for cheaper alternatives for products or services you regularly use.

- Consider negotiating bills or subscriptions to lower monthly costs.

Allocating Funds Towards Debt Repayment

- Set a specific amount from your budget to allocate towards debt repayment each month.

- Prioritize high-interest debts first to save money on interest payments.

- Avoid accumulating more debt while paying off existing ones to make progress faster.

Developing a Repayment Plan

When it comes to tackling debt, having a solid repayment plan is key to getting back on track financially. There are various strategies that can help individuals pay off their debts more effectively. Let’s explore some of these strategies below:

Snowball Method vs Avalanche Method

- The snowball method involves paying off the smallest debt first, regardless of interest rate, then moving on to the next smallest debt. This approach can provide a sense of accomplishment and motivation as debts are eliminated one by one.

- The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. By tackling high-interest debts first, individuals can save money on interest payments over time.

Consolidating Debt

Consolidating debt involves combining multiple debts into a single loan with a lower interest rate. This can make it easier to manage debt and potentially lower monthly payments. To consolidate debt effectively, individuals should shop around for the best consolidation loan terms and consider the impact on their overall financial situation.

Negotiating with Creditors

Effective negotiation with creditors can help individuals lower interest rates, waive fees, or even settle debts for less than the full amount owed.

By communicating openly with creditors and demonstrating a willingness to repay debts, individuals may be able to secure more favorable terms. It’s important to approach negotiations with a clear understanding of one’s financial situation and a realistic repayment plan in place.

Increasing Income

When it comes to paying off debt faster, increasing your income can make a significant impact. Here are some tips on how to boost your earnings:

Side Jobs

If you have spare time outside of your regular job, consider taking on a side job. This could be freelancing, tutoring, pet sitting, or any other gig that aligns with your skills and interests. The extra income can go directly towards paying off your debt.

Selling Unused Items

Take a look around your home and identify items that you no longer need or use. You can sell these items online through platforms like eBay, Craigslist, or Facebook Marketplace. Not only will this declutter your space, but it will also bring in extra cash to put towards your debt.

Investing or Starting a Small Business

Consider investing in stocks, mutual funds, or real estate to generate passive income. If you have a passion or a skill that you can monetize, think about starting a small business on the side. Whether it’s selling handmade crafts or offering consulting services, a side business can bring in additional income to help you tackle your debt.

Seeking Professional Help

Seeking help from a financial advisor or credit counseling service may be necessary when you feel overwhelmed by your debt and are unsure of the best way to tackle it. These professionals can provide expert guidance and support to help you get back on track financially.

Debt Management or Debt Consolidation Programs

Debt management programs involve working with a credit counseling agency to create a plan to repay your debts. These programs typically involve negotiating with creditors to lower interest rates or monthly payments. Debt consolidation programs, on the other hand, involve combining multiple debts into a single loan with a lower interest rate.

- Debt management programs can help you create a structured repayment plan and negotiate with creditors on your behalf.

- Debt consolidation programs can simplify your debt repayment process by combining multiple debts into one manageable monthly payment.

- Both options can help you lower your overall debt burden and make it easier to pay off what you owe.

Finding Reputable Professionals or Organizations

When looking for professionals or organizations to assist with debt reduction, it’s important to do your research and choose reputable and trustworthy individuals. Look for professionals who are accredited, have positive reviews, and are transparent about their fees and services.

Always be cautious of any professionals or organizations that promise quick fixes or charge high fees upfront.